Since a year ago, IOTA became less whimsical in the marketing and analysts are wondering can IOTA’s tangle survive due to the loss of money for the project which we can notice in the practical milestones and lower objectives as we are reading more about in the IOTA news today.

IOTA is at risk of running out of cash which can be seen from the tensions between the co-founders and the lack of commercial use cases for the Tangle. The project is working on expanding market opportunities by taking a pragmatic approach to the development of technology. However, the team has to overcome key issues that are smothering the project.

The main roadblocks for the evolution include centralization, lack of commercial use cases, and the small ecosystem. The team could also run out of money which is why many wonders Can IOTA’s tangle survive that blow. The IoT space is growing faster and the critical infrastructure is being built so IOTA’s adoption prospects are only going to increase.

To capitalize on the opportunities, IOTA has to provide practical working solutions for enterprises and organizations and since this was a problem before because the team focused on innovations, it is not fully embraced still by hardware producers. In 2020, the project made moves to prioritize the conventional software development. Without casting the innovative ideas, the team is focusing on improving the usability and efficiency of the current version of the Tangle. The improvements include automatic connection, faster transactions, and reusable addresses that are coming with Chrysalis.

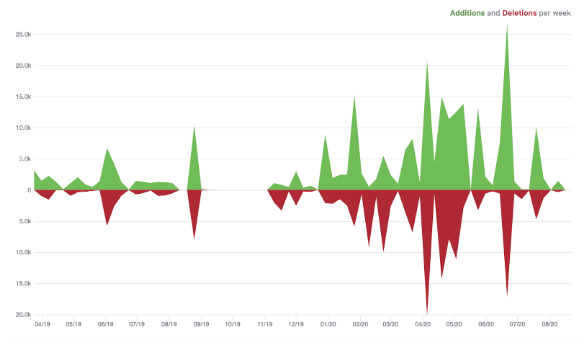

The fact that the team is prioritizing conventional development practices is promising. Given the years spent on research and the issues with internal politics, should not come as a surprise. The spike in the activity of the team is dictated by the financial resources of IOTA’s Foundation as it now has over 59.6 trillion Miota tokens valued at $23.8 million. Over the past year, the average monthly burn rate was set at 4.6 Ti. With this rate, IOTA’s foundation has until 2021 before running out of the holdings.

There’s also an Ecosystem development fund and some cash could be left from the initial $1 million endowments from the founders. Considering how much money the team will spend, the sources are not enough to relieve the risk. The market crash in March only made the situation worse. Although IOTA followed the bullish trends, the price recovered to the pre-crash levels in August.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post