The Whales sold more than 1 million ETH coins before the price of the asset collapsed so the top 100 ETH addresses sold off more than a million tokens a few days ago as we are reading more in the latest Ethereum news.

Ethereum’s price has been dropping over the past few days and lost more than $200 in value at one point. According to a report, the price drop came after the top 100 ETH exchange addresses dumped more than 1 million tokens. Until a few days ago, Ethereum’s price was on a roll and the second biggest crypto by market cap increased to a 2-year high at $490. With a bull run like this one, the community wondered how long will it take for the second-biggest cryptocurrency to surpass $500.

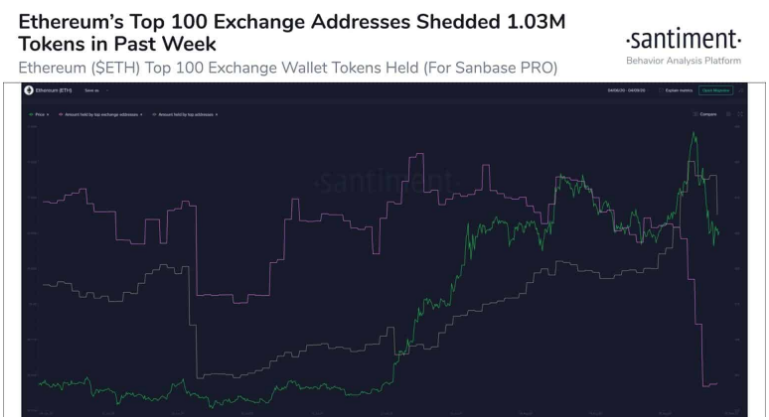

The situation reversed right after and instead of reaching another high, ETH started losing value instantly. The asset broke below the $400 before hitting a bottom at about $310 and lost about 35% at the same time. The data compiled from Santiment reveals that Ethereum whales sold off their coins and are ahead of the curve as the ETH price started speeding up towards its recent high as the top 100 exchange addresses started disposing of their tokens.

The company concluded that these addresses “decreased their tokens held from 16.92 million to 15.89 million in the past week” which marks a huge drop of over 6% that was almost certainly a “sparkplug to the massive price dump.” The report indicated that the number of developers that utilize the network has been surging since 2018 so the ETH-specific code packages that were downloaded in 2020 exceed the downloads from 2018 and 2019.

The Medalla testnet is responsible for attracting over 1.1 million test Ethers which is a huge increase from the numbers a week ago. Medalla serves as the final testnet before the official launch of ETH 2.0 which aims to initiate the transition from the current proof-of-work consensus algorithm to proof-of-stake with 38,000 validators that staked their ETH which is already earning returns. These developments have contrasting effects as the increased usage implies that more users are employing the ETH blockchain which outlines a lot more notable issues.

The network has become clogged as the mempool displays more than 160,000 pending transactions which will increase the fees on the network. The average fees paid at the start of September jumped to the highest level of $6.60 while ETH miners benefit from the profits skyrocketing. However, users are waiting for the release of ETH 2.0 and they hope to improve their experience.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post