The volume of ETH options market has hit a new record high with the demand for the coin surging over the recent weeks. The demand surge likely follows the high-profile confirmation of the ETH2 release which formalized after the deposits to the ETH 2 contract address reached its limit. Let’s find out more in today’s Ethereum news.

An analyst from Deribit, one of the biggest crypto options market said:

“Our ETH Option Open Interest is at a new ATH of $826 million! The Christmas day expiry leads with over 669k ETH OI. ETH Put/Call Ratio for this strike: 1.19 ETH Maximum Pain for the 25th of December expiry is at $400!”

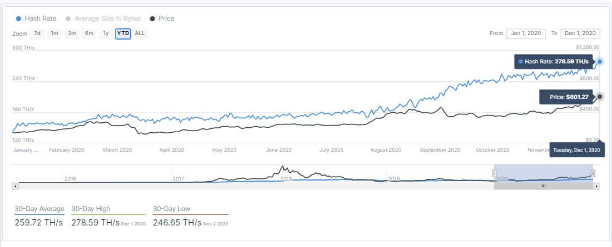

As a result, Ethereum is going to see some increase in volatility as well by the end of December as a large options expiry nears. The increase in the trading activity of ETH has been reflected by the fundamentals of the platform that are ever-improving. For example, an on-chain analysis company IntoTheblock reported that the hash rate of the ETH network remained at its all-time high. This only shows that there’s a growing demand for ETH as it shows miners are returning back to allocating their resources and are mining ETH more than ever.

In the near-term, despite the release of ETH2, mining on the ETH blockchain network will continue and as long as mining coexists on the blockchain, the rising hash rate will remain a positive metric for the coin also becuase the volume of ETH options increases. The ETH2 network upgrade moved ETH from a proof-of-work consensus algorithm to a proof-of-stake algorithm which will eliminate mining overall. But in the near future, the PoW chain will co-exist with the Beacon chain, as analysts noted:

“While the introduction of the Beacon Chain marks the beginning of the end for #Ethereum miners, the network’s hash rate has sustained near its all-time highs. Even though the Beacon Chain genesis went live the proof of work chain will also continue to work in parallel.”

Analysts outlined that there’s a rising interest across various subsectors in the ETH ecosystem like Mythos Capital co-founder Ryan Sean Adams who reported that 1% of all ETH supply is locked into ETH bonds. He noted that this outlines how many individuals are seeking exposure to the ETH economy which is an indication that people think ETH is equal to money:

“There’s already 1% of all ETH supply locked in ETH bonds. Not even a week after launch. There’s clear demand for non-sovereign internet bonds. People want exposure to the Ethereum economy. And these bonds are denominated in money. Because ETH is money.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post