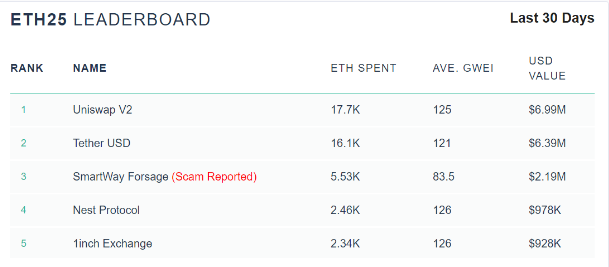

The Uniswap traders have spent about $7 million in Ethereum fees over the past month according to the gas tracking site ETH Gas Station as we are reading further in the upcoming Ethereum news.

The average GWEI which is a unit of Gas was around 125 with more than 17,700 ETH spent by the Uniswap traders and users. other decentralized exchanges such as Khyber Network and 1Inch accounted for $968,000 and $336,000 in fees with an average Gwei value of 126 and 100 respectively. Uniswap emerged as the DEX of choice for the new projects and scams and anyone is now able to list the ERc20 token on the 2018 founded protocol and it seems that the demand is booming as the fees shown.

The accessibility coupled with the yield farming hype spurred a huge speculative activity and the rise of tokens like PASTA, DEGEN, and SHRIMP. However, despite the funny names, investors are putting their money into the tokens. the trading on TEND last month, the token of the Tendies deflationary project, hit $7 million in one day as investors flooded in. YAM, the Yam Finance’ token, saw similar volumes as well as before the smart contract vulnerability took the project down. In the meantime, Tether which is pegged to the US dollar was the second-highest gas booster on Ethereum as users spent more than $6.3 million in fees.

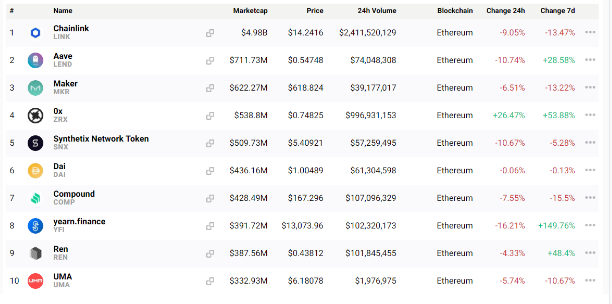

The third biggest gas user was Forsage which is also a controversial project flagged as a “scam” on the ETH Gas Station. The project came under the scanner thanks to the Philippines government after the ties to a broader Ponzi Scheme. Ethereum is the network of choice for most developers and tokens as all ten of the top DeFi tokens on the site tracker shows that they are built on ETH with Terra coming on the 14th place.

The Defi sector is down by 6.7% over the past day and 2.98% in the past week after the major surge of 100% from July to August. The sector volume increased by $5.08 billion with a $3.58% of the total market. The macro sentiment, for now, is bullish with the DeFi sector leading the gains. However, ETH is strained and traders are paying massive fees over the past weeks because of that.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post