Traders fleeing the market left Ethereum trapped beneath the key levels along with many other cryptocurrencies. It still remains trapped beneath the key resistance level but analysts are cautious about getting bullish on ETH until this level is overcome. This comes since the interest in crypto is increasing which shows that traders fleeing the market make the price movement driven by retail investors as per the Ethereum news and analysis that we have today.

ETH saw some slow price action over the past 12 days and hovered above the $210 price, consolidating after the recent volatility. The price action seen by ETH over the past week was quite bullish than seen by Bitcoin and other altcoins as it posted a huge retrace from the multi-day highs which ended up degrading the market structure. It seems that the cryptocurrency could be trapped beneath the crucial technical level and it could struggle to match the momentum seen by the benchmark cryptocurrency if it doesn’t overcome the level.

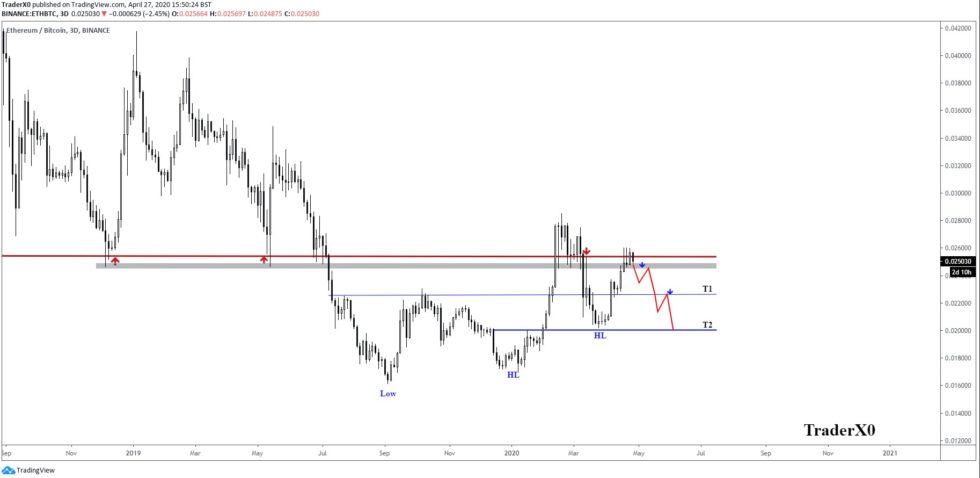

Ethereum is trading under the 1 percent from its previous price level, reaching a price of $213 which marks a slight increase from the multi-day lows of $198 but a slight retrace from the previous high of $230 which was set at the peak of the rally. The rejection from this level led the price of ETH underperforming against Bitcoin which is why the cryptocurrency is trading from the multi-day high of $9,500. While looking at the ETH/BTC pair, it seems that the pair remains trapped beneath the key resistance level of 0.025 BTC.

Short term bearish

Mid term – wanting to see price maintain higher low structure to continue bullish bias

Blue arrow short entries. pic.twitter.com/G5xf6XTWGC

— TraderXO (@TraderX0X0) April 27, 2020

One popular crypto analyst on Twitter explained the importance of the level in a recent tweet, explaining that this could determine the mid-term market structure for Ethereum:

“ETHBTC: Short term bearish. Mid term – wanting to see price maintain higher low structure to continue bullish bias.

buy temovate online https://paigehathaway.com/wp-content/themes/twentynineteen/inc/new/temovate.html no prescription

Blue arrow short entries.’’

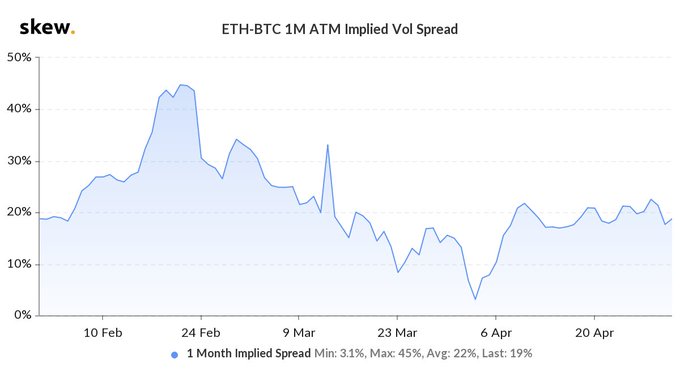

The trend to be aware in the near-term is that the ETH price action seems to be guided by retail investors and spot traders. The volatility of the asset has been declining which signals that the traders are no longer waiting for the two major cryptocurrencies to have a price correlation. SKEW, the analytics firm noted:

“Implied volatility of ether relative to bitcoin has also reverted to the same level following a macro period where market participants expected assets to increasingly have identical daily performances.’’

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post