The outflows of ETH from exchanges are reaching new highs as the price of the second-biggest cryptocurrency surges so let’s take a closer look at today’s latest Ethereum news.

The large outflows of ETH from exchanges are considered a sign that the traders are not looking to sell which could be quite bullish for ethereum. More than $500 million worth of ETH was withdrawn from the crypto exchanges over the past week with the traders looking to hold on to their coins in anticipation of bullish price action. The data from IntoTheBlock shows that 180,000 ETH was withdrawn from exchanges on Tuesday and the figure represents the highest aggregated exchange withdrawal of ETH since October. At that time, the outflow of ETH preceded a 15% price increase for the coin in 10 days.

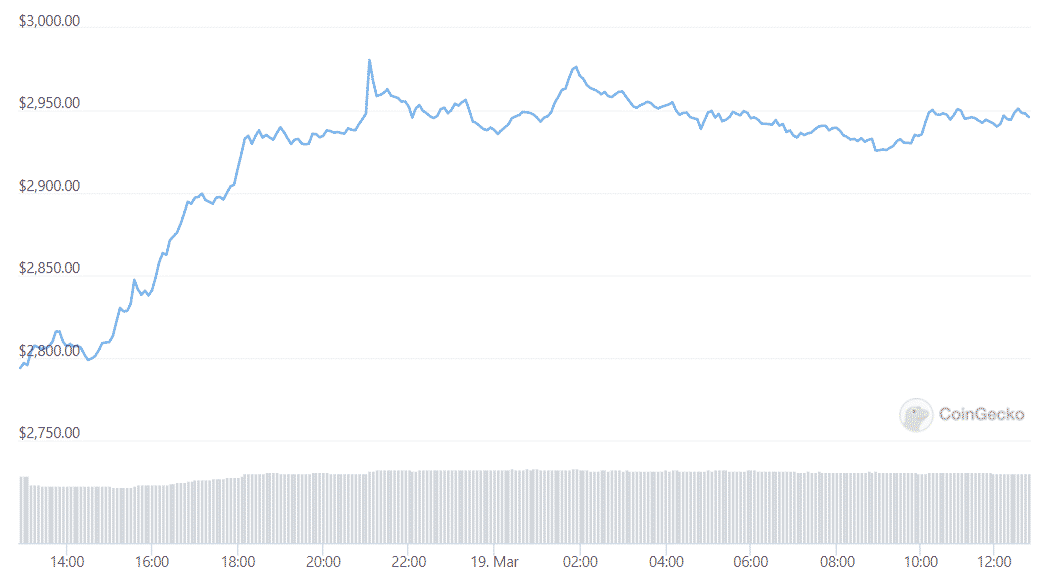

Ethereum’s price has also been following the massive outflow and it traded at $2500 on March 15, with the coin surging to $2934 at the time of writing. This marks a 17% increase over the week and made ETH the only top 10 coins by market cap to see a double-digit gain beside AVAX. The data from Chainalysis shows that up to 352,217 ETH could have left exchanges on the same day but the company provides a wide range of the data set. Also, it is worth noting that Chainalysis hasn’t estimated an outflow this big in the past six months.

According to the company, such outflows can be considered a bullish market indicator:

“Assets held on exchanges increase if more market participants want to sell than to buy, and if buyers choose to store their assets on exchanges.”

ETH’s gains on the wider crypto market can’t be ignored as well. Every top 10 coins besides Terra was increasing over the past week especially after the FED announced a 25 basis point interest rate hike. BTC increased by 8% and saw a possible 39,000 BTC outflow on Friday which amounted to about .

buy synthroid online https://rxbuyonlinewithoutprescriptionrx.net/synthroid.html no prescription

6 billion. The data from IntoTheBlock noted that 190,000 ETH was deposited for staking funds using Lido which is a service that allows users to stake various assets on other chains such as Ethereum 2.0. the deposit contract now has over 10,000,000 ETH staked on it and amounts to $27 billion in staked value.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post