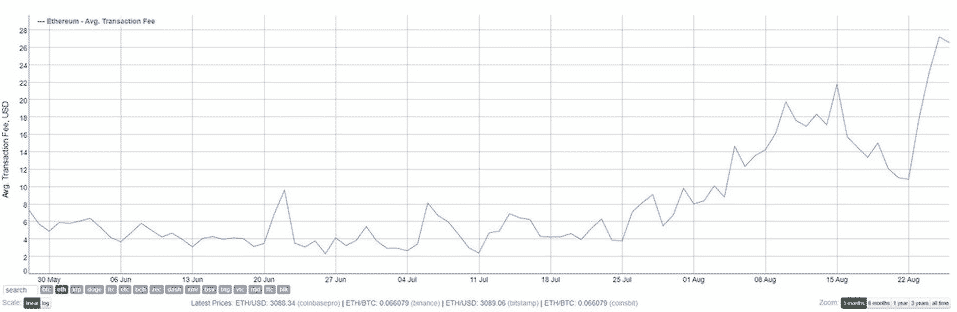

The NFT craze sent ethereum gas prices to a 14-week high as the non-fungible tokens saw a resurgence this month with the transaction fees skyrocketing as well once again so let’s read more in our latest ethereum news today.

Ethereum users are now suffering against as the transaction fees spiked to their highest levels for 3 months and according to Bitinfocharts, the average fees surged to $27.23 which is an increase of around 240% since the start of August. The last time gas was this high was during May when the average prices spiked to $60 before that was an ATH for gas at $70 on May 12. The prices are average so the operations like token swapping or smart contracts activities are going to get higher and according to the Etherscan gas tracker, the Uniswap token swap can cost about $30 right now.

Cryptofees reported that the Ethereum network generated a stunning $32.7 million in fees a day ago and this is 98% more than BTC which generated $629K in the network fees on August 26. NFTs are the cause of the gas increase as the hype mounts again. As per Nonfungible, August will be the highest month in regards to sales as it already notched up $900 million in the past month. OpenSea, the NFT marketplace is the biggest gas spender right now with around $5.7 million network fees generating over the past day. It represents about 21% of the total gas used on ETH over the past day and Axie Infinity which was listed on Coinbase recently is up there as well as it guzzled over $933K in gas over the past day.

Yep pretty much all NFT markets..

Not buying any more NFTs tonight though unless they're > 1ETH value because it's not worth spending $200 gas fee on anything cheaper. 😑

Damn gas fees. (yes I know about SOL and AVAX NFTs I'm just a boomer and haven't set up my wallet yet) pic.twitter.com/s6D1gONmpd

— NebraskanGooner📈 (@nebraskangooner) August 27, 2021

According to Cryptoslam, CryptoPunks and Axie Infinity dominated the Non-fungible token sales over the pOpeast 30 days which generated $850 million and $500 million and Art Blocks as the third most popular with $438 million in sales in the past month. The NFT craze sent ethereum gas prices higher as the price of the underlying asset powering all of the networks has actually retreated by 1.7% in the past day. Ethereum was trading at $3108 as per CoinGecko and the asset gained 35% over the past month but remained 29% from its ATH of $4357.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post