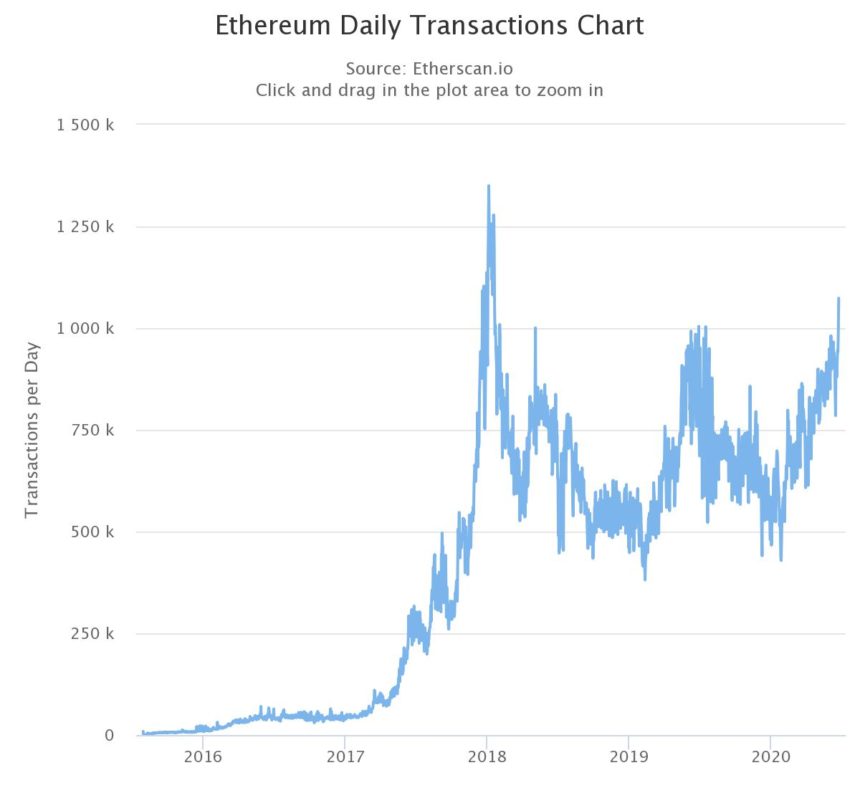

The massive DeFi demand sparked the daily ethereum transactions to a new 2-yearly high which is a level unseen since January 2018 so let’s find out more in the following Ethereum price news.

In the past few months, the network activity on Ethereum surged as a result of the rising demand for decentralized finance applications and the growing anticipation of ETH 2.0. Since January 2020, in a period of six months, the daily transaction volume of the Ethereum blockchain increased from 435,000 to 1,073 million. The two main factors that triggered the 146% surge in user activity on Ethereum was the surge in investors sending funds to DeFi apps and the on-chain stabelcoin transfers.

The massive DeFi demand also happened because the users found out it allowed them to carry out conventional financial services in a decentralized environment. For example, with DeFi, crypto investors can lend their surplus holdings to the borrowers, and then, the borrowers can incentivize the lenders with monthly returns. For the users to start using DeFi, they need to send funds on the blockchain network which can be ETH, Tether, or any other token that they hold. The users need to send transactions to and from Defi apps.

Once the demand from DeFi continues to increase, it will lead the transaction volume on the blockchain network to expand quickly. The increasing usage of stablecoins such as Tether will fuel the growth in the daily volume of Ethereum. Tether released an ERC20 compliant version of the stablecoin about three years ago and it was then possible to send and receive USDT via ETH wallets. USDT’s valuation increased to over $9.1 billion surpassing a huge user base. The strong appetite for Tether led the user activity on Ethereum to increase.

The on-chain data shows that the basic factors behind Ethereum are getting stronger three months after the Black Thursday event. The crypto market crashed in tandem as the investors started to panic-sell. Bitcoin dropped to low as $3,600 while ETH dropped below $100. The total amount of capital locked in DeFi market crashed from $1 billion to less than $500 million. The DeFi market completed a V-shape recovery while the total value in Defi surpassed $1.53 billion. Compound surpassed Maker and Synthetix to become the most dominant DeFi protocol which has $588 million on its network. whether the optimistic fundamentals of ETH and DeFi demand will cause a short-term frenzy for ETH, remains to be seen. Co-founder of CoinMetrics Jacob Franek wrote:

“For example, it could take another 2-5 years before very large institutions are comfortable shifting critical infrastructure onto ETH 2.0 and purchasing stake. That doesn’t happen in 6 months under any optimistic scenario.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post