The high gas fees are not an issue for ethereum alone because rivals like Avalanche and Solana are not immune despite having smaller fees. As they grow, they can experience some spikes in gas fees as well as we are reading more in today’s altcoin news.

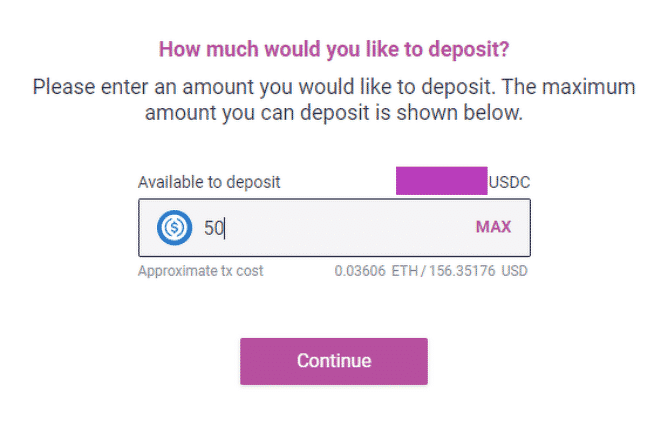

A few weeks ago, the debate over the ETH high gas fees emerged once again when rival smart contracts like Solana are gaining more traction. Gas fees are likely to remain a huge issue in Defi no matter the chosen chain. Ethereum is the first and most popular smart contract layer-1 blockchain but is very expensive to use. Simple token swaps on decentralized exchanges can be costly and more complex.

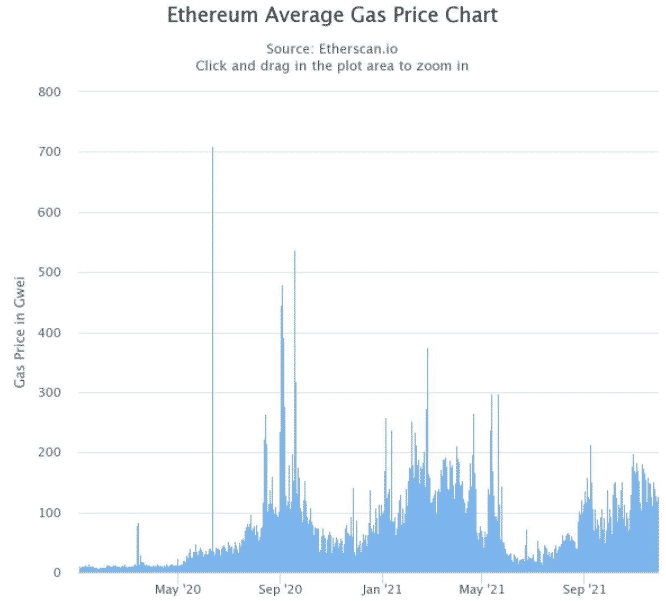

In the bull market that started around January 2020, the fees on Ethereum remained a sore eye for users and there were even more spikes and drops but the average gas prices have never been so high for so long. This is because as the bull run continues, more users are joining the network every day. The narrative was a huge boon for the layer-1 networks like Solana and Avalanche as they pitch a rich crypto experience without the high costs. One Redditor wrote back in August when he was using a decentralized exchange on Avalanche:

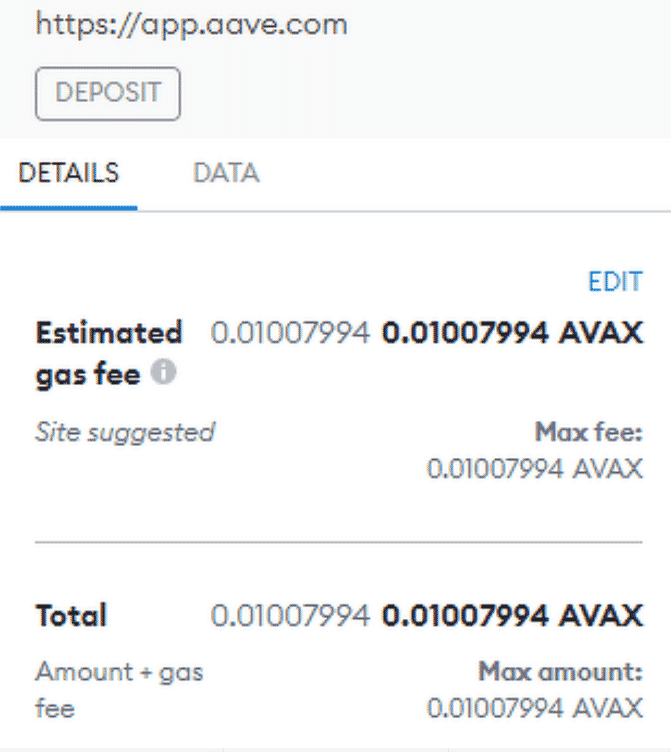

“Almost [$2] for [a] small transaction on Pangolin. Seems like [no one] talks about this. Is it just me who [minds]? How do you want to make P2E games on this? Will go back to [a] lower fees chain prob.”

Another wrote:

“I’m very impressed with the speed of this network, but in terms of fees Polygon and Kucoin networks are far far cheaper. I make over 1,000 transactions/week so AVAX in [its] current state [it’s] just not for me.”

The subnets which are similar to sidechains on Ethereum, batch activity away from the mainnet and allow for higher throughput and low costs. These kinds of networks are fee markets where the transaction competes for block space to be processed so when the block space fills up, the market becomes more competitive. Solana and Avalanche did just increase the block size so the trade-off here is that becoming a node operator or a validator has higher hardware demands which could cause a centralization risk. But however you see it, more activity will bring higher prices no matter how you see it. If we believe that blockchain technology is to underpin the financial markets, then the current landscape hints that the future is going to be expensive.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post