Hackers looted 2600 in crypto from the Rari Capital Ethereum pool according to a report released by the core contributors as we read more in our latest Ethereum news.

Ethereum based yield aggregator Rari Capital was attacked over the weekend by bad actors and the hackers looted 2600 in crypto in the aftermath. The attacker took place on May 8th with a series of transactions lasting for hours. Rari Capital’s product deposits ETH into Alpha Homoras’ iBET interest-bearing token as a part of the strategy.

The protocol’s pool contract operates with the ibETH.totalETH()ibETH.totalSupply() used to calculate the exchange rates for the pairs and a separate report from Alpha Finance LAbs claims that this operation can lead to incorrect assumptions. According to Alpha Finance, the ‘ibETH.totalETH() was manipulative inside the work function and the users can call any contracts if wants to inside ibETH work including the Rari capital Ethereum pool deposit and withdrawal functions.

On Ethereum, the attackers started when the bad actors took a new loan from DYDZ for around 59,000 in the cryptocurrency, and the funds were into Rari Ethereum based pool with a correct conversion rate for the aforementioned trading pair. The attackers used the function work which enabled them to trigger an offensive with encoding and Evil token contract which allowed the hackers to inflate their ibETH/ETH rate. The possible root of the exploit was discovered and the actions on Alpha Homora were paused. The losses represented around 60% of all the users’ funds in the eETH-based pool but only Rari’s funds were lost.

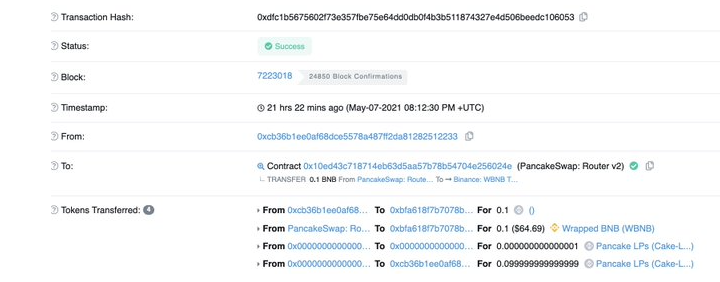

At the end of the ibETH.work, Rari Capital Ethereum Pool’s balances reached low values than ever before, even before the attack as a result of the attacker withdrawing more than they deposited while the balance was inflated artificially. Igor Igamberdiev who is a researcher revealed that the exploit was more complex than usual as the separate report from him shows that the attack on Rari Capital was the first cross-chain exploit in the crypto space. The researcher believes that the hackers took the funds from a Binance Smart Chian yield aggregator called Value Defi which suffers multiple attacks on its products.

On the Binance Smart Chain, the hackers crated a fake token which was pool into the exchange PancakeSwap which allowed them to interact with Alpaca Finance. To fight these attacks in the future, Rari Capital took additional security steps like checking invariants of potential malfunctions and protocol integration.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post