Greyscale purchased almost 50% of all mined ETH coins in 2020 as the institutional interest for crypto is growing. In the following Ethereum news today, we take a closer look at what this could mean for the asset.

The digital asset management company outlined the increased interest from the institutional investors and they believe that the upcoming Ethereum 2.0 could be the reason why. Some of the latest information on the matter show that the total number of ETH mined from January 2020 up until now, was 1,563,245.875. In the meantime, the Greyscale investments ethereum trust issued 5,230,200 shares as of 2019. According to the website, the company had 13,255,400 shares up until today.

Simply explained, with 0.09427052 ETH per share, it seems that Greyscale purchased 756,239.777 ETH in the same period. This means that the company purchased almost 50% of all of the miner coins this year. The reports from the company about the Q1 performance show that the institutional investors have been accumulating huge chunks of the second-largest digital asset by market cap despite the price volatility.

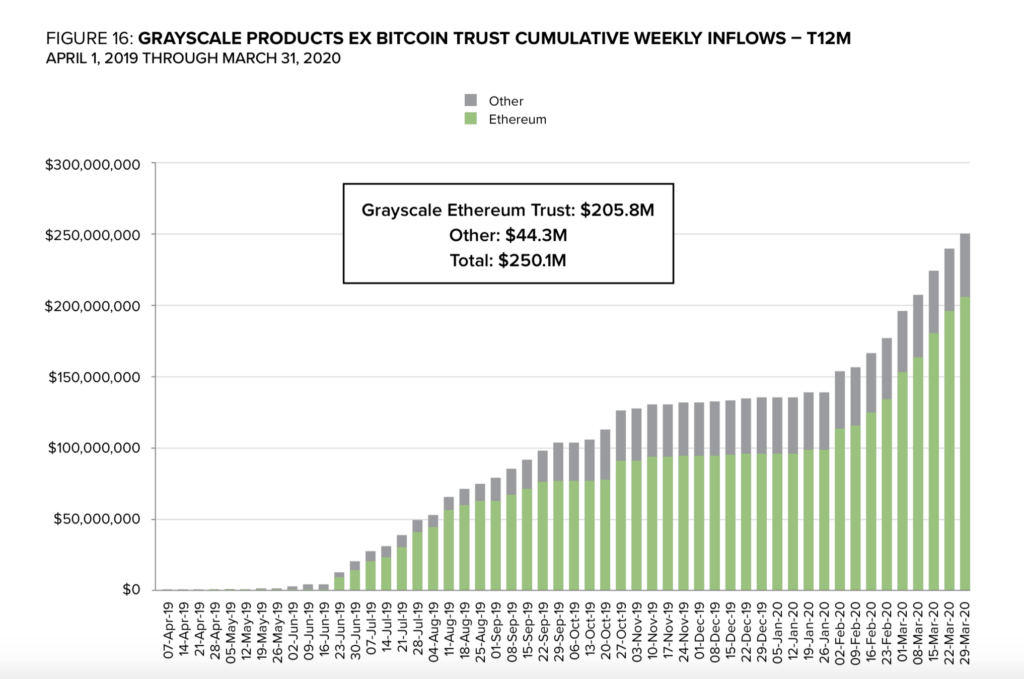

During the first quarter of the year, the Ethereum Trust saw a $110 million in inflow which is more than all of the previous inflows combined for the past 2 years or $95.8 million. The upcoming release of Ethereum 2.0 will complete the migration to the Proof of stake algorithm which could be one of the reasons behind the high purchase levels. In the annual documents on the ETH developments, Greyscale introduced the new concept and said that some of the benefits will be the increased scalability of the database.

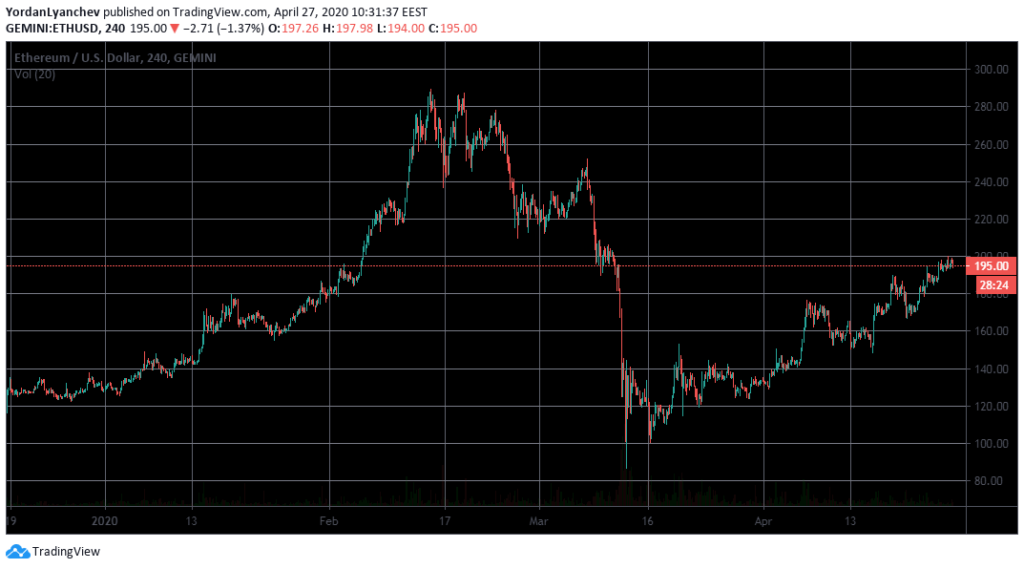

The Ethereum investors didn’t slow down as well even with a premium of about 420%. One share of ETH cost $92 to buy on April 24th while the holdings per share were worth about $17. The institutions are paying bigger premiums as they don’t worry about storing and transferring the cryptocurrency on their own. The spot price of the asset gained more than 50% since the start of the year. ETH entered 2020 at $130 and is trading at $195.

The price of Ethereum hit a yearly high of $290 in February but plunged to $87 during the Mid-March crash. In order to continue the upwards, the price of Ethereum has to break the first resistance of $198.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post