Grayscale just bought more than $74 million for its Ethereum trust which is an SEC-registered way to invest in the cryptocurrency as we can read more in today’s ethereum news.

The world is obsessed with crypto as of late and Greyscale looks like it is too. Grayscale just bought $74 million for its ETH trust after buying more than $280 million in BTC last week. According to a report by Grayscale to the SEC, the company revealed that they bought 11455 ETH for a total of $74,135,609 which is a decision that comes after a very bad year for Ethereum with the rise of DeFi projects and the launch of ETH 2.0 as the leading reasons behind it being the rally of its native token.

Genesis Trading, which is a US-regulated crypto trading platform founded in 2013 which acted as an intermediary to facilitate the token purchase. Since the sales reported on the recently filed Current Report on Form 8-K by Grayscale Ethereum Trust, it issued 1,416,300 shares at varying prices with private placements transactions exempt from the registration requirements from the Securities Act that is pursuant to the Rule 506. The trust is a good way for the bigger institutions to invest in crypto. Grayscale’s purchases of ETH tokens are a sign of institutional interest and that shows how big the traditional investors are keen on the emerging market.

Unlike the typical exchange, Grayscale has products that are fully regulated derivatives in the United States which makes it safe to jump in and operate with them. The Grayscale Ethereum Trust is now advertised as a company as the “only SEC-registered way to invest in Ethereum.” Investors are buying shares in the trust with the commitment to hold their funds and when the lockdown ends, they can choose to sell the shares on the market. the company doesn’t participate in the market and doesn’t buy back its clients’ shares so since the market is independent, the company is not guaranteed liquidity or price stability. It, therefore, participates to give out lucrative premiums from trading in the market.

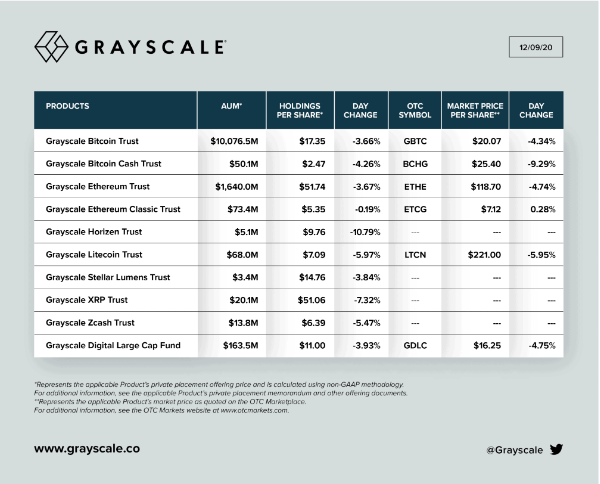

The Grayscale ETH trust is the second biggest trust after BTC which is in fact the biggest trust in the world while ETH accounts for 13.7% of the total funds while BTC accounts for more than 82%. Grayscale announced purchasing of about $62.9 million which matches the sentiment on the markets. December was quite a bullish month so it comes as no surprise that a lot of investors are putting their money on ETH and other assets.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post