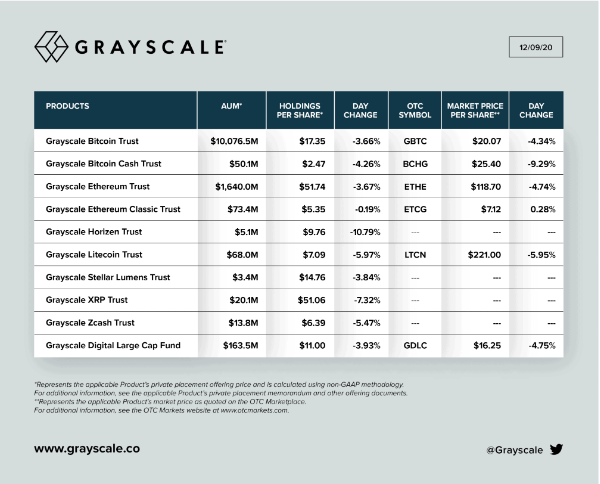

The Grayscale ETH shares are trading at a discount with the ETH Trust and BTC trust both being below the value of the actual crypto assets, but what exactly is happening? Let’s find out in our ethereum news today.

Just this week, the shares in the grayscale Bitcoin trust started trading at a discount after years of trading at a premium. However now, the Grayscale ETH shares are trading at a discount as well for the first time since they opened in 2017. The investment products are available via over-the-counter markets under the symbol ETHE and traded at a 5.2% discount a day ago as it normally trades at a premium above 5%.

Grayscale's Ethereum trust goes negative -5.21% pic.twitter.com/bvyKdsUyJP

— unfolded. (@cryptounfolded) February 26, 2021

The Grayscale Ethereum Trust is an investment vehicle that takes investors’ dollars and uses them to purchase Ether but instead of the investors receiving the ether, the company holds it on their behalf and issues shares that will track the price of the coin. However, there’s a slight catch as the shares of ETHE rarely trade for the same price as the actual ETH and they cost more than the underlying asset.

There are few reasons for that. The first one is that Grayscale charges a 2.5% annual fee while some investors pay it because the trust is regulated and the company assumes the risk of holding the keys. Grayscale also does well with this model as the trust controls 3.

buy vilitra online https://cleanandclearadvantagerecovery.com/wp-content/themes/twentytwentyone/inc/new/vilitra.html no prescription

17 million ETH coins over 2.7% of the circulating supply of the coins. Another factor playing into the discount could be the sixth holding period before the investors are able to turn around and sell their shares. According to QCP Capital CIO Darius Sit, the premium usually drops as the trading desks cash out and claim the premiums:

“GBTC trading at a discount to the price of Bitcoin doesn’t necessarily indicate bearish outflows.”

As reported recently, The Ethereum core developers set their eyes on April 14 for the Berlin hard fork at the block height of 12,244,000 according to the report concluded on Friday. The hard fork includes different optimizations for contracts like gas efficiencies, updates to how code is ready by the Ethereum Virtual Machine, and other changes to protect against the denial of service attacks

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post