ETH’s options expiry at the end of June will be the main make or break event for the year as bulls and bears are both nervous about the outcome so let’s read more in our latest Ethereum news.

On June 25th, ETH’s option expiry which is the biggest expiry in 2021 as $1.5 billion worth of interest will be settled. The figure is 30% larger than March’s 26 expiry which happened as Ether price dropped 17% in about a week and bottomed to $1550. however, Ether rallied 56% after March’s options expiry and reached $2500 within three weeks. The moves were uncorrelated to BTC so it is essential to understand if a similar market structure is underway for June 25.

The history shows a mix of bullish and bearish catalysts as March 11, Ether miners organized a show of force against the EIP-1559 that will reduce their revenues. The situation got much worse as CoinMetrics launched an Ethereum Gas report which stated the highly anticipated network upgrade will solve the high gas problems. Things started to change as Visa announced more plans to use the Ethereum blockchain to settle one transaction made in fiat and then the Berlin upgrade was successfully implemented. According to the reports, after the Berlin hard fork launch, the average gas fees started to decline to more “manageable levels.”

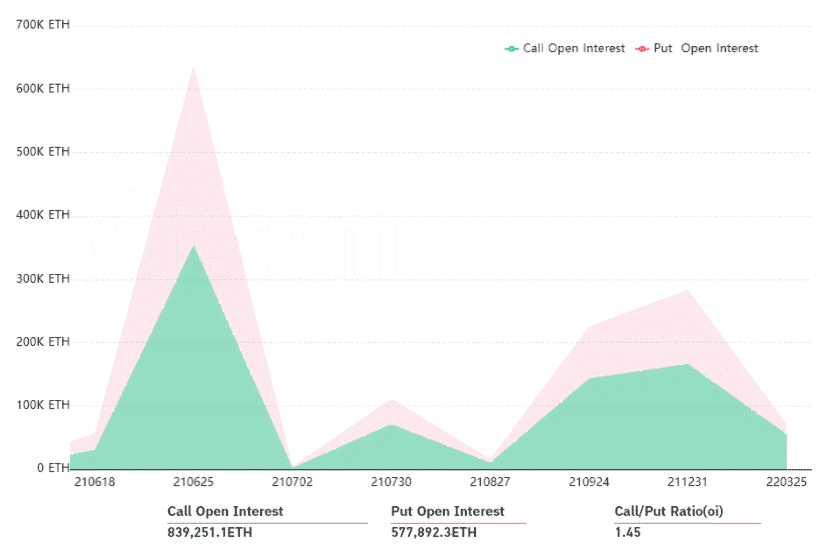

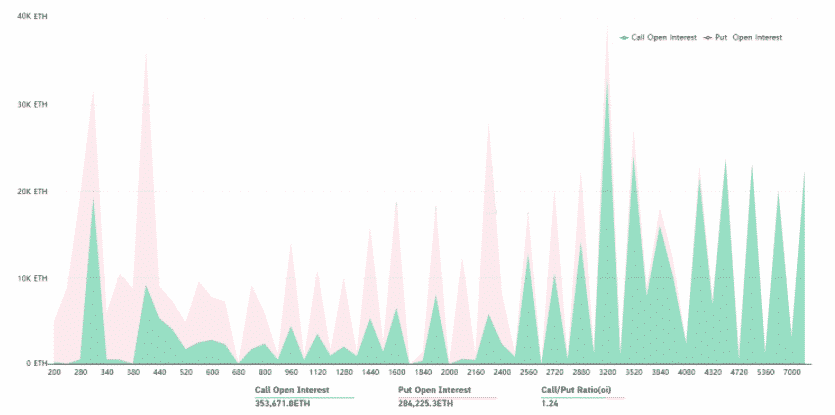

Before bringing a conclusion and speculating whether these phenomena of the ETH price bottoms out at the options expiry are bullish or bearish, it is the best way to first analyze how large traders are positioned. Make sure to take notice of how the expiry holds over 638,000 ETH options contracts and totals out at 45% of the $3.4 billion open interest. Unlike futures contracts, the options are divided into two segments. Call/buy options allow the buyer to acquire Ether at a fixed price on the expiry date and these are used on neutral arbitrage trades or bullish strategies. In the meantime, put/sell options are used as a hedge from negative price swings.

There’s a disproportionate amount of call options at $2200 and higher strikes which means that if Ether’s price happens to be below this level, about 73% of the neutral-to-bullish options will actually be worthless. The 95,000 call options still in play mean that it will represent $228 million open interest.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post