Ethereum’s interest can surpass the 2017 levels if it is able to surge above $1500 as we can see in today’s ETH news.

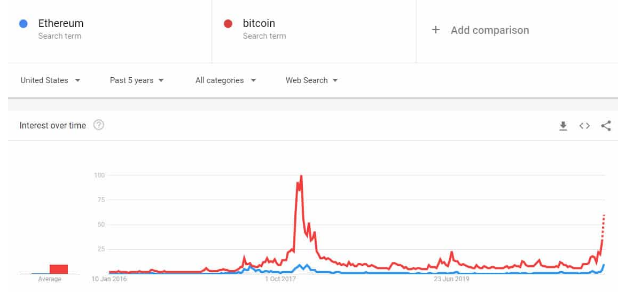

The internet searches and Ethereum’s interest are likely to surpass the 2017 levels according to Google Trends while the price reclaimed its $1100 level. The data from Google Trends suggests that the searches for ETH are skyrocketing as the price remains in the four-figure territory. The surge in interest is predicted to eclipse levels in 2017 when the asset entered the crypto scene driven by the ICO boom.

In 2017, ETH prices surged 9600% from $8 to $775 today before the push to that all-time high of $1400 two weeks later. The public sector management consultant “DCinvstor” commented that this is the cycle in which ETH will go mainstream.

I've said it before, but I'll say it again:

This is the cycle #Ethereum & $ETH go mainstream and enter the zeitgeist.

Every Boomer & Gen X fund manager on Wall Street eyeing Bitcoin now will know and understand (conceptually) what Ethereum is by the end of 2021. https://t.co/bYbH0mQA87

— DCinvestor | Aftab (@iamDCinvestor) January 6, 2021

by the end of the previous bull market, everyone will see what BTC was all about its coverage in the mainstream media making the asset a household name. The same didn’t happen with ETH which remained under the radar for the masses and for the institutions. Right now, things are looking different as the institutions arrived but the mainstream retail traders largely stayed away. The investors added that the things are very early for ETH:

“And before everyone freaks out and starts calling ‘that’s the sign of a top,’ recognize that Ethereum had only a fraction of the market awareness Bitcoin had in 2017.”

This is evident when comparing the two search terms. Things are heating up for ETH when ETH 2.0 is properly launched which is at least a year away. Phase 1.5 will merge into two blockchains and the early adopters that staked on Beacon Chain long before they are able to reap the rewards. At current prices, there’s about $2.5 billion worth of ETH locked in the deposit contract. Compared to the BTC market capitalization of $640 billion this is a tiny fraction and compared to the gold’s $12 trillion market cap it doesn’t register.

Ethereum’s prices are back in the bull’s territory following yesterday’s brief market cooled down during the Asian trading sessions with the price touching $1150 once again. Another leg up could meet the resistance at 30 where the previous weekly candles closed in 2018.

buy forzest online https://galenapharm.com/pharmacy/forzest.html no prescription

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post