Ethereum’s DEX volume crashed in October as Sam Bankman-Fried predicted that the surge in trading volume would be short-lived and he was right.

buy neurontin online http://www.mrmcfb.org/images/layout4/new/neurontin.html no prescription

In today’s ethereum latest news, we are reading more about it.

In early October, Sam Bankman Fried, the CEO of FTX which operates the decentralized exchange Serum, predicted that a surge in trading volume on Ethereum’s DEXs will not last. Volumes dropped sharply across decentralized exchanges in October as he also identified what he called “fake volume.” At the LA blockchain summit in early October, FTX CEO said that the summer surge in volume on Ethereum’s DEX was “bullshit” with no guarantee of a bullish future.

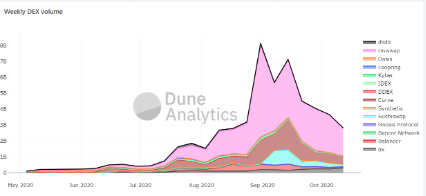

It turns out that Bankman Fried also operates the DEX Serum and according to Dune Analytics, the trading volume on Ethereum-based DEXes fell dramatically in October. The volume is down by 45% over the past 30 days. Decentralized exchanges are nothing like Binance and Coinbase. While the centralized exchanges hold custody over the cryptocurrencies, decentralized exchanges don’t. the most popular of the decentralized ones are Uniswap. The weekly trading volume on these exchanges during the summer and peaked over $8 billion mainly because of the decentralized finance protocols offering newer incentives with the potential for bigger returns.

Bankman-Fried went into detail about how he got that conclusion. What was happening on the decentralized exchanges, we roughly analogous to the trans mining while Centralized exchanges sometimes reward traders with native tokens like Huobi, Binance Coin, and so on:

“Very little meaningful volume happened on these exchanges. The reason you ask how much volume an exchange has is to answer questions like: How important is it? How much liquidity does it have? How important is it for pricing? Where should someone be advised to trade? How great is its future? How much money is it making?”

None of the questions were answered by the sort of “fake” volume numbers which resulted from trans mining and that he claimed was mainly because of what happened with DEXes this summer thanks to the incentives. The daily trading volume at the time of writing is over $100 million which is down from $1 billion in September:

“Once [exchanges] stopped paying people to fake volume.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post