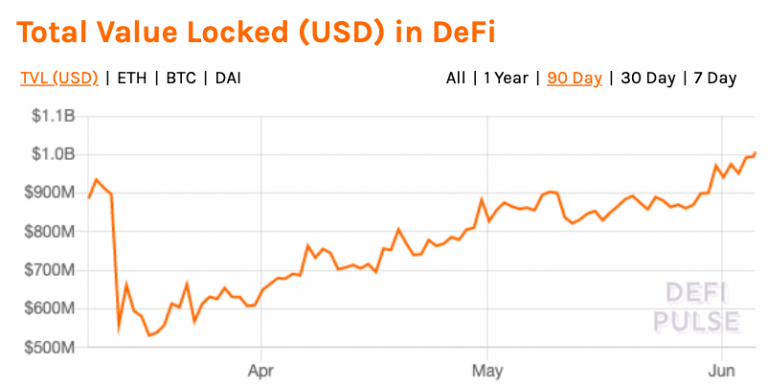

Ethereum’s DeFi is back at $1 billion as the asset prices helped the entire DeFi space return to over $1 billion in locked-in value as per the Ethereum news.

Ethereum’s DeFi is once again at $1 billion of value locked in MakerDAO which accounts for over half of the amount. Some other notable growth from Set Protocol and Aave continue to bolster the DeFi value as well. As DeFi surges on the improvement crypto market sentiment, the lending protocols and decentralized exchanges are doing well as speculative activity increases.

Most of the value locked in Defi comprises of Ether and stablecoins. ETH’s 85% asset prices increase since April 2019 could be the main reason for the surge as more of the traders are coming back to lending protocols to increase their leverage in the spot market positions. Aave is a flash loan platform that saw immersive growth with a total increase in liquidity from $20 million in March to more than $80 million at the time of the press.

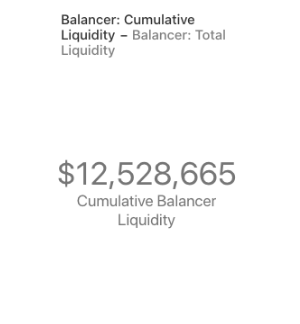

The protocol’s growth is a result of the offering borrowers the chance to take a loan at a variable rate. This mechanism is responsible for fuelling higher lending rates for Aave. Set Protocol is an automated investment protocol on Ethereum that grew from less than $2 million of locked value to more than $15 million in six months. Uniswap and Bancor released upgrades to their protocols in the past few months as well. The decentralized exchanges face stiff competition from Balancer which launched two months ago and has more than $12 million of liquidity. With a few DeFi centric layer 2 scaling solutions launched on the ETH mainnet in the past week, the optimism for Ethereum’s DeFi space grows continuously.

As per the recent reports, The Ethereum blocks are not enough for the Defi applications according to the data from Covalent. The reports say that the DeFi importance is growing each day and it could even overtake the Ethereum value transactions in the long run. In perfect scalability solutions, all types of transactions can grow but in order for Ethereum to grow, the others have to be destroyed. The growth of the DeFi sector and the increasing block size demand will become quite expensive so there has to be more scalability achieved with Ethereum 2.0.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post