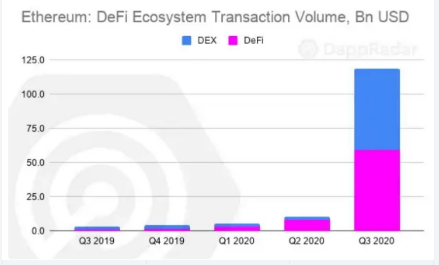

Ethereum’s DeFi apps volume increased by 99% of the blockchain’s transaction volume in Q3 this year as we are reading more in our ethereum news today.

Ethereum’s Defi apps volume skyrocketed to $119.5 billion in the third quarter of the year according to DappRadar’s report which is almost 1200% increase compared to Q2. Decentralized Finance applications accounted for 99% of the volume which means it crushed the ETH gaming sector. The transaction volume on the ETH blockchain reached $119.5 billion in Q3 2020, marking a surge of nearly 1200% compared to the previous quarter according to DappRadar’s industry report today.

DappRadar 2020 Q3 #Dapp Industry Report is out!

We're covering the performance of 13 #blockchains listed on DappRadar.

– The activity across the dapp ecosystem has grown by 115%.

– Total transaction volumes reached $125B in Q3 2020.

Read our Q3 #report https://t.co/ryyKTl5OLf

— DappRadar (@DappRadar) October 2, 2020

According to the report, Ethereum’s transaction volume reached $10.2 billion a few months ago in the second quarter of the year. This type of increase became possible thanks to the ongoing decentralized finance space which keeps attracting yield farmers. Among the 13 blockchains listed on DappRadar, ETH accounts for 96% of the total transactional volume, retaining its title as the biggest network by far. At the same time, the Defi space was responsible for 99% of these figures:

“We spot that the DeFi ecosystem is not only the number one category but also holds 99% of the value within the Ethereum blockchain in Q3 2020.”

The DeFi boom led to a huge drawback as the fees increased rapidly. Over the past few months, ETH miners started setting new records in terms of their profits, earning $500,000 and $800,000 even $1 million per hour in fees alone. The miners earned more from the transaction fees than from the block rewards which is the first time in ETH history. This of course doesn’t seem to bother Defi at all. After all, people choose to yield farming to make more money so the high transactions are a part of the game. however, overblown fees started chocking other DeFi apps as DappRadar noted:

“In Q2 2020 we witnessed a tremendous drop [in the Games category] and the trend has continued into Q3 2020. The reason behind it is still high Ethereum gas prices and looking at the prevailing trends of the DeFi ecosystem, it doesn’t look like that situation is going to change anytime soon.”

Apart from collectibles, gambling, gaming, other dapps are having a hard time with high transaction fees as well. Some of them are joining the defy hype so it seems that all of ethereum is now on Defi too.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post