Ethereum’s 150% rally is about to reverse according to the latest fractal analysis that we have in our ETH news today. The asset performed quite great in the past seven weeks especially since it rallied after the Black Thursday.

Since the $88 low, Ethereum’s 150% rally happened and reached a high of $228 earlier today at the local peak of the rally. Many of the traders believe that this is only the start of another bigger move citing that the technical strength of the uptrend in Ether is present. The fractal analysis by a crypto trader and other factors, predict that Ethereum’s 150% rally will soon run out.

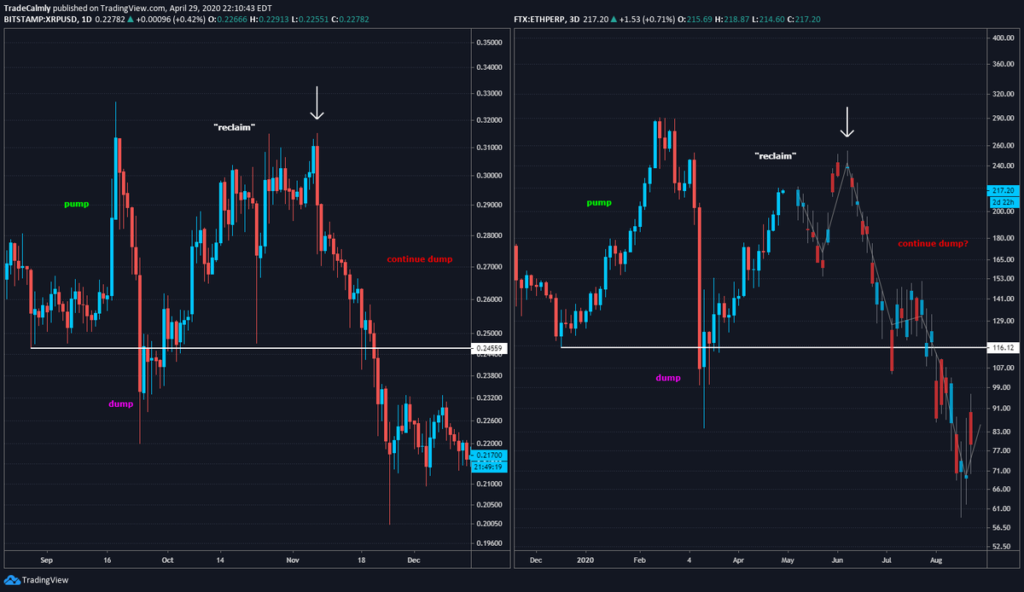

The crypto market seems irrational as some may be seen but the market can be analyzed through a variety of different means. According to a leading crypto trader, one such indicator is the fractal that repeats a historical price action over the other time frames and with other assets. to prove this, he shared a chart that shows how Ethereum’s chart from December looks similar to the XRP price action in 2018. The chart suggests that this fractal should play out totally as Ethereum will likely crash to fresh yearly lows by the end of this year.

The fractal analysis receives a lot of attention from the skeptics as they claim that it is irrational to expect the assets to show repeating patterns on a few occasions because of the sample sizes which is the existence of the coincidences and the sentiment that the charts can be manipulated to fit the fractals. The trader made it clear that he believes that the fractals are a valid form of analysis for Ethereum explaining in the chart below:

“Markets are a reflection of human psychology and coming up with ‘reasons’ for price action is just retconning.”

The bearish outlook for ETH comes as analysis has suggested that the price of ETH could embrace the stablecoin project such as the Tether USDT and USD coin which present a long-term threat to the value of ETH. The continued rally in Bitcoin price could stop the correction of Ethereum while a crash in BTC could enable the bearish scenario. The ETH holders and analysts are optimistic about the prospects of BTC moving forward from both fundamental and technical perspectives.

A report analyzed by Ryze explained that the fiat regime is being pushed to new extremes with money printing negative interest rates meaning that there is a potential for more inflation and potential for alternative coins to grow more.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post