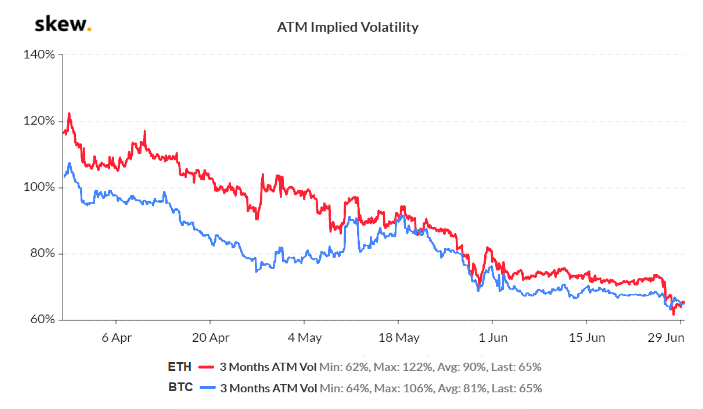

The current Ethereum volatility shows a drop below the Bitcoin volatility for the first time ever – but some say that this is not a bullish nor a bearish development. In fact, the ETH options implied volatility, a measure which details the expected price swings as per the options markets premium.

When the Ethereum volatility dropped below Bitcoin for the first time ever, analyst following the ETH news said that investors have given up expectations of a price decoupling – or simply expect the price of Ether to move and mirror Bitcoin.

From what we know following the potential catalysts for significant price moves, implied volatility tends to move up while an absence of triggers causes the volatility to recede, along with a diminishing premium on the options markets. Below is a visual representation from Skew markets.

We can see in the chart above that the Ethereum volatility along with the one of Bitcoin have dropped, which can be partially explained by the Bitcoin halving occurring in mid-May. At the time, many investors had reasons to believe that prices could oscillate more drastically as the possibility of various miner capitulations loomed.

At the same time, some positive news from the strong inflows by Grayscale Investments showed numerous advancements on the ETH 2.0 testnet, as well as a growing DeFi ecosystem which boosted traders’ expectations.

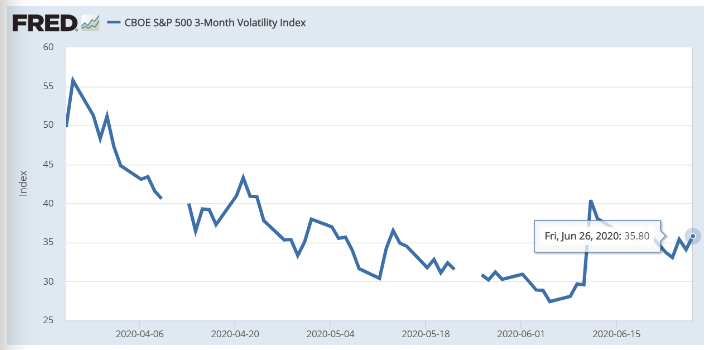

There are now many reasons behind the Ethereum volatility and its comparison to the S&P 500, and some of the most notable ones include the enormous untapped potential of digital assets as well as the existing uncertainties related to the evolution of different protocols behind the coin.

Meanwhile, the Bitcoin put/call options ratio tells a different story – the total 40% of the current open interest is down from a 80% during its pre-halving peak. Again, this is not something that should be interpreted as a bullish or bearish indicator in the Bitcoin news now.

In the long run, the ETH options are more active and this paints a different and more bullish picture. Many analysts expect ETH to jump after its July ETH 2.0 release and post new yearly highs.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post