The latest Ethereum news show us that the Ethereum staking 2.0 feature is a potential thing to look out for. When it goes live, many people will be able to earn rewards – but how much can you earn with Ethereum staking?

The Ethereal Virtual Summit 2020 which happened today has a magnitude of topics, one of which is the “What kind of economic returns can stakers expect to make?” From a retail investor’s perspective, the answer is far from simple. According to Collin Myers who is a global product strategist at ConsenSys, the Ethereum staking 2.0 will bring many novelties to the current blockchain.

Speaking of, the blockchain news show that Ethereum 2.0 is a massive network upgrade which will bring improvements to the blockchain, starting with “phase zero.” Among the other things, it will also pave the way for Ethereum to transfer to a proof-of-stake (PoS) consensus algorithm, which will move away from the current computationally intensive proof-of-work (PoW) algorithm.

For all of you who don’t know, the main difference is that in PoS users will be able to “stake” – which means lock up – their Ethereum, which will be used to verify new blocks, consequently helping support the network. Stakers will receive rewards for their contributions – the greater their stake is, the greater the reward will be.

Myers noted that the Ethereum 2.0 network must reach quite a few important milestones before ETH holders could begin to wonder about potential profits from staking. First and foremost, 2.0’s first – or “genesis” block – won’t be discovered until the total amount of staked ETH reaches over 524,000 which is approximately 16,000 validators.

“No one will receive any rewards until this point is reached,” Myers added.

So, what profits can early stakers expect?

As Myers noted, starting from the genesis block, expenses for maintaining a validator node will cost users around 4.75% of their rewards. As more ETH is staked on the network, the percentage will get higher since the rewards will begin shrinking.

“At five million ETH staked, the cost will rise to about 14.7%,” Myers stated. “Which results in your net issuance essentially being between 17% and 3.7% from genesis until five million ETH staked,” he added.

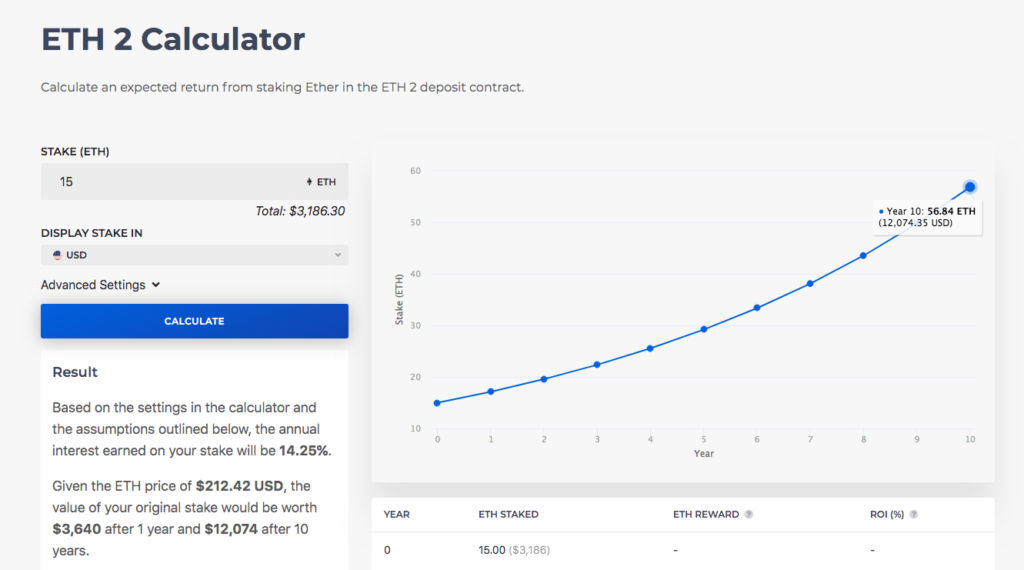

In the end, Myers warned all potential stakers that the Ethereum staking 2.0 on the network is designed to be “highly open” which means that the rates of return will be variable. So, one of the best ways to calculate your staking returns is through the EthereumPrice.org calculator.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post