The Ethereum price surged by more than 1500% since the end of 2016 while the current technicals are still bullish for the price. The ETH/USD pair is nearing a golden cross of the 50 and 200 days EMA within the next week which could increase the chances of a bullish period ahead as we are reading below in the latest Ethereum news today.

Ethereum is a distributed ledger decentralized platform with smart contract capabilities. The asset is the second on the BraveNewCoin market cap table of $23 billion and $2.53 billion in trading volume. The ETH project was initially proposed by Vitalik Buterin in 2013 while the other co-founders include Anthony Di Iorio, Mihai Alise, Amir Chetrit, Charles Hoskinson, Joseph Lubin, Jeffrey Wickle and Gavin Wood. The ICO happened in 2014 which raised $16 million with each token selling for $0.31 but ended up as the most successful ICO in history.

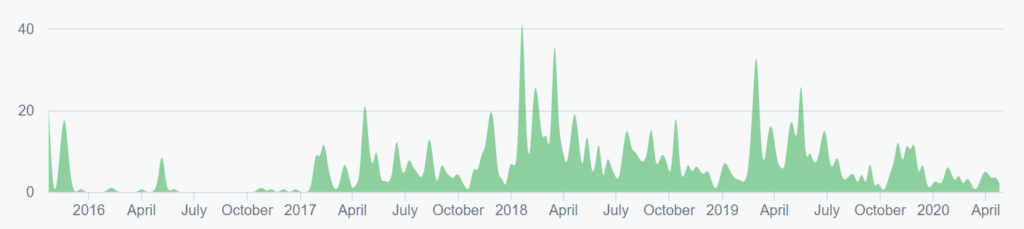

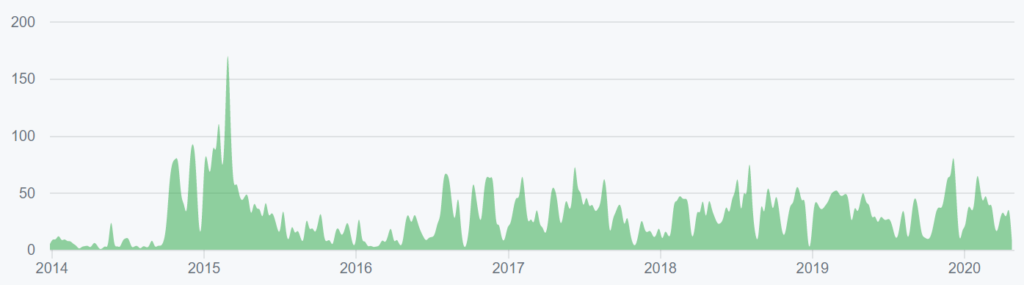

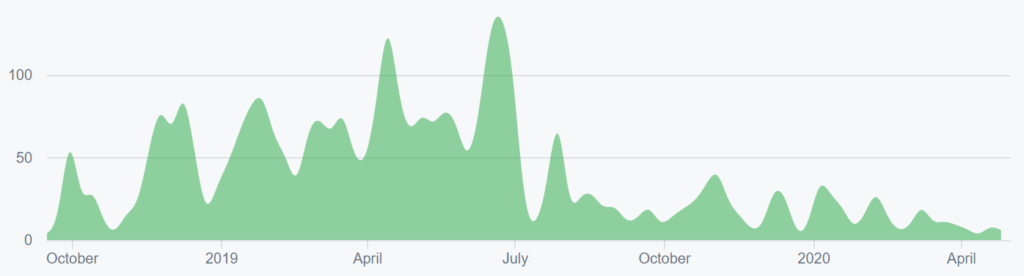

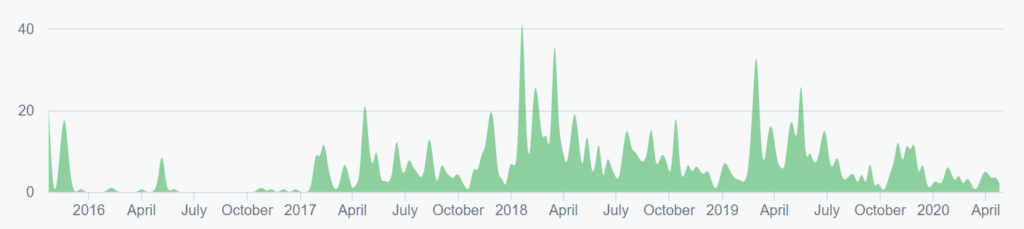

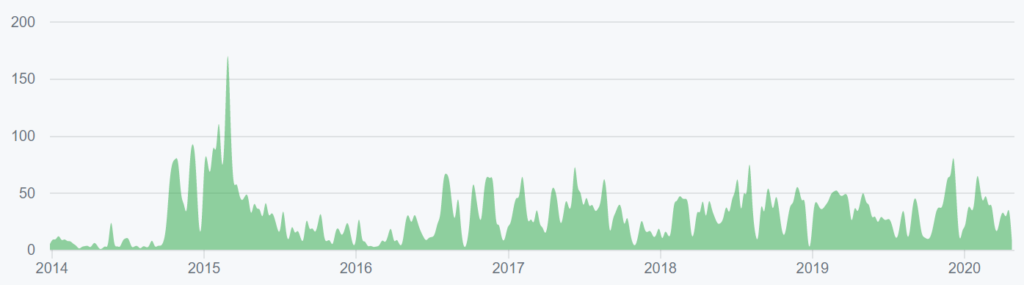

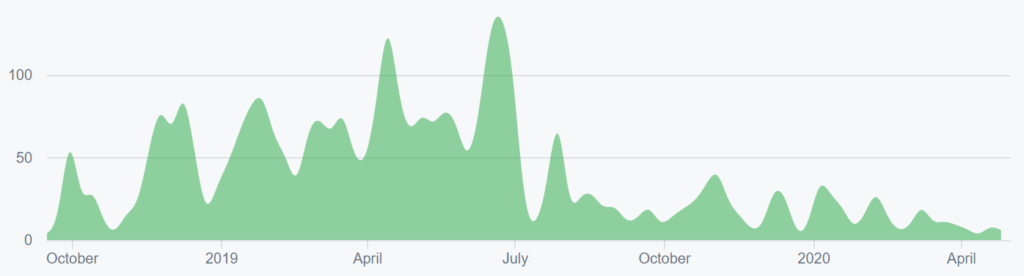

The network main net went live in 2015 with 72 pre-mined coins which amounted to 65% of the circulating supply. Wickle sent 92,000 ETH to the Kraken exchange and ETH was launched with no schedule or lock-in period for the pre-mined coins. Ethereum was upgraded through multiple improvement protocols which were bundled into each hard fork. Almost 4000 developers contributed to 28,000 commits to the ETH project in the past year and most of the commits occurred in the Solidity repo.

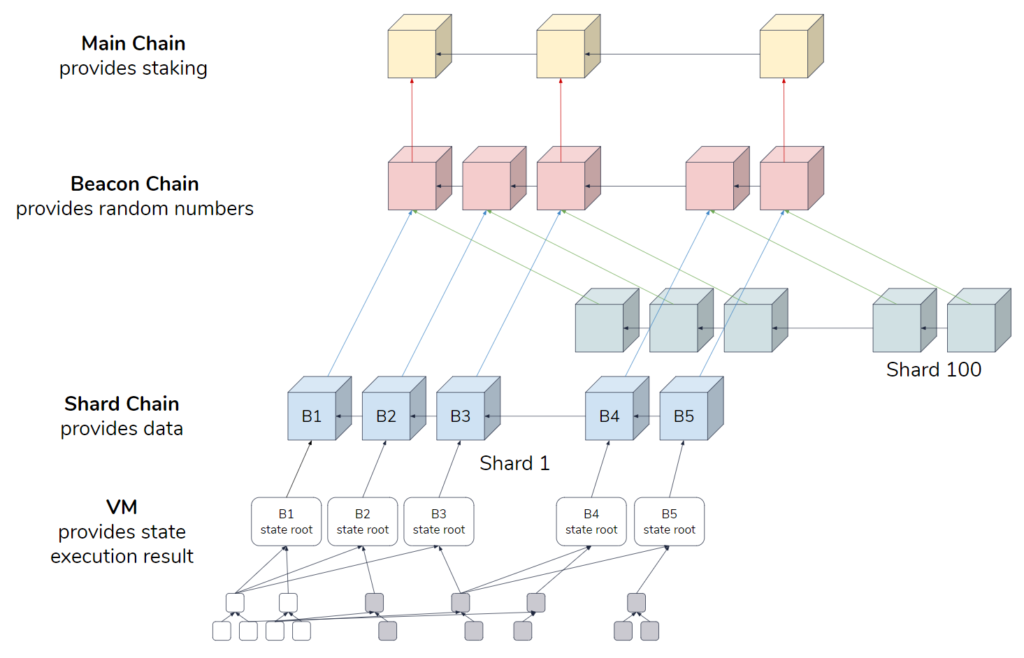

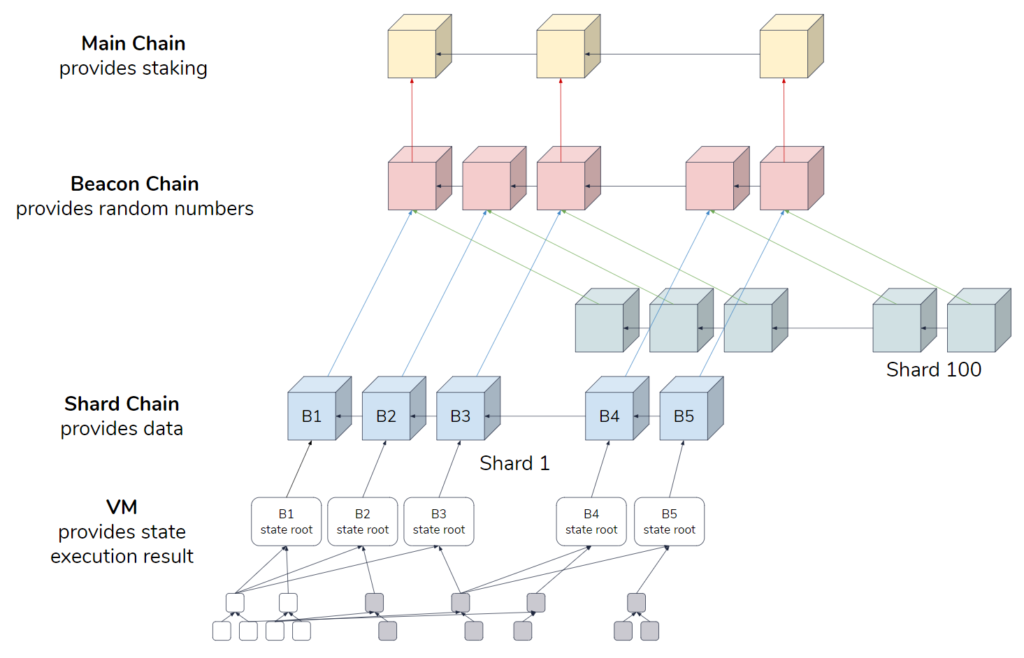

With all the developments and upgrades, the Ethereum price surged by 1500% from 2016 until now. With ETH 2.0 the network was drastically changed and the full implementation of Casper aimed to remove the Proof of Work from the network and replace it with the Proof of Stake. There are now no plans to cap the total amount of ETH created. ETH’s ProgPoW is likely to be implemented in the future if the hash rate increases are driven by the ASICs, Bitmain, and PandaMiner.

If implemented, EIP 1057 will make all of the current ETHash ASICs unable to mine the chain, and those using ETHhash ASICs will have the option to continue mining the pre-fork chain while other possibilities include the ASICs getting used to mine Ethereum Classic. The goal of decreasing the ASIC use on the ETH chain will be a temporary success. The mining profitability had increased since January thanks to the ETH prices but still remains near all-time lows if the prices drop further, the hash rate will follow.

The Ethereum price surged by more than 1500% since the end of 2016 while the current technicals are still bullish for the price. The ETH/USD pair is nearing a golden cross of the 50 and 200 days EMA within the next week which could increase the chances of a bullish period ahead as we are reading below in the latest Ethereum news today.

Ethereum is a distributed ledger decentralized platform with smart contract capabilities. The asset is the second on the BraveNewCoin market cap table of $23 billion and $2.53 billion in trading volume. The ETH project was initially proposed by Vitalik Buterin in 2013 while the other co-founders include Anthony Di Iorio, Mihai Alise, Amir Chetrit, Charles Hoskinson, Joseph Lubin, Jeffrey Wickle and Gavin Wood. The ICO happened in 2014 which raised $16 million with each token selling for $0.31 but ended up as the most successful ICO in history.

The network main net went live in 2015 with 72 pre-mined coins which amounted to 65% of the circulating supply. Wickle sent 92,000 ETH to the Kraken exchange and ETH was launched with no schedule or lock-in period for the pre-mined coins. Ethereum was upgraded through multiple improvement protocols which were bundled into each hard fork. Almost 4000 developers contributed to 28,000 commits to the ETH project in the past year and most of the commits occurred in the Solidity repo.

With all the developments and upgrades, the Ethereum price surged by 1500% from 2016 until now. With ETH 2.0 the network was drastically changed and the full implementation of Casper aimed to remove the Proof of Work from the network and replace it with the Proof of Stake. There are now no plans to cap the total amount of ETH created. ETH’s ProgPoW is likely to be implemented in the future if the hash rate increases are driven by the ASICs, Bitmain, and PandaMiner.

If implemented, EIP 1057 will make all of the current ETHash ASICs unable to mine the chain, and those using ETHhash ASICs will have the option to continue mining the pre-fork chain while other possibilities include the ASICs getting used to mine Ethereum Classic. The goal of decreasing the ASIC use on the ETH chain will be a temporary success. The mining profitability had increased since January thanks to the ETH prices but still remains near all-time lows if the prices drop further, the hash rate will follow.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post