The Ethereum positive catalysts could lead the price to skyrocket by 200% which means ETH could reach $750 as we are reading further in the upcoming Ethereum price news.

Bitcoin could be down by 50% from its all-time high but Ethereum registered a harrowing performance over the past days. Even after rallying 175% from the March lows, the price of the asset remained lower than the 80% below its all-time high of $1,430. Some remarked that the inability of the asset to recovery is the death knell for the Ethereum bulls but some analysts suggest that ETH still has the opportunity to see some decent upside.

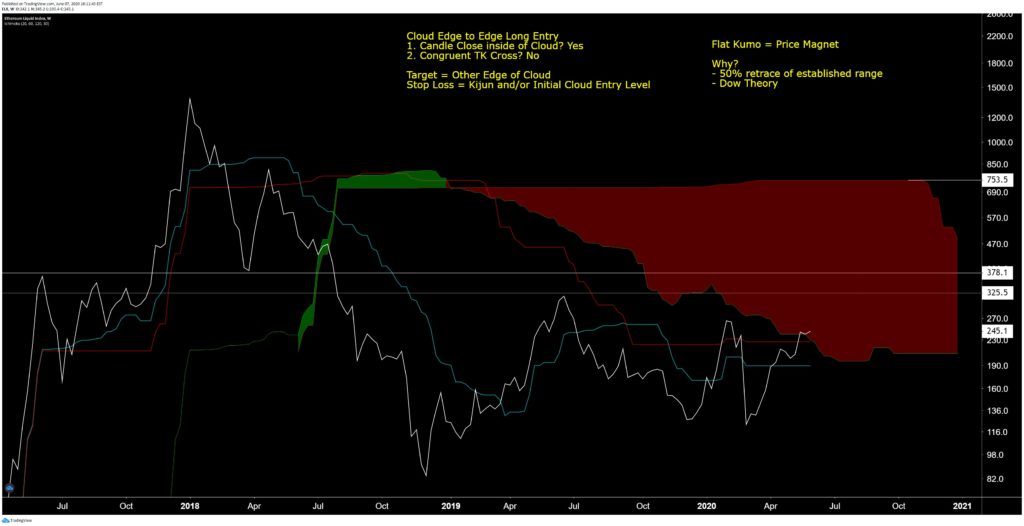

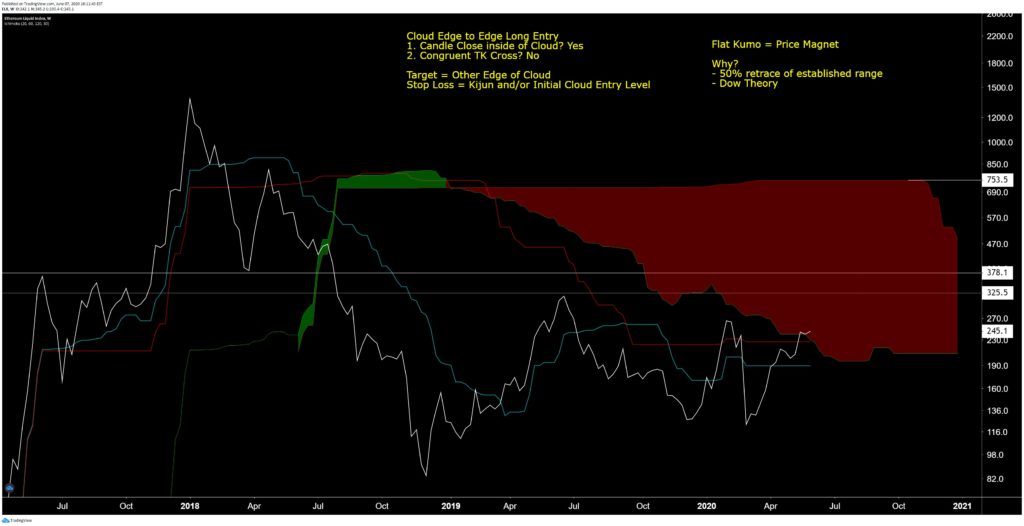

According to the analyst Josh Olsewicz, Ethereum’s one-week chart is showing signs that it wants to rally 200% to the $750 region in the upcoming months, thanks to the Ethereum positive catalysts. He shared a chart indicating that ETH entered into the key Ichimoku Cloud resistance that is showed with red. Referencing how the asset will rally to the other end of the resistance is called the ‘’end-to-end move’’ as Olszewicz remarked:

“One-week Ethereum chart. End to end to $750 triggers within the next few months probably.”

Backing the positive technicals, there are some fundamentals that are in favor of the Ethereum bulls as an analyst said. Ryan Watkins, a research analyst at the crypto data company Messari, said:

“In short, Ethereum is being used more than ever, and in just two years, Ethereum has evolved from a blank canvas to an agglomeration of novel forms of value and use cases.”

The increased usage of the underlying blockchain is quite positive for ETH because according to the analysis, the transaction fees that the ETH miners get are linked to the movement of the cryptocurrency. If ethereum usage spikes, so will the underlying asset. Analysts are also becoming more bullish on Bitcoin. This could make Ethereum and Bitcoin closely linked as the rallies will help both the assets. Bitfinex’s order book data shows that there’s clear support of the $9,500 level which is important as order book data was critical in predicting the swings in the price of the cryptocurrency in recent years. The charts also show that the order book data supported Bitcoin when BTC was trading in the $4,000 back in March while nailing the $10,500 highs that were seen over the past few weeks.

The Ethereum positive catalysts could lead the price to skyrocket by 200% which means ETH could reach $750 as we are reading further in the upcoming Ethereum price news.

Bitcoin could be down by 50% from its all-time high but Ethereum registered a harrowing performance over the past days. Even after rallying 175% from the March lows, the price of the asset remained lower than the 80% below its all-time high of $1,430. Some remarked that the inability of the asset to recovery is the death knell for the Ethereum bulls but some analysts suggest that ETH still has the opportunity to see some decent upside.

According to the analyst Josh Olsewicz, Ethereum’s one-week chart is showing signs that it wants to rally 200% to the $750 region in the upcoming months, thanks to the Ethereum positive catalysts. He shared a chart indicating that ETH entered into the key Ichimoku Cloud resistance that is showed with red. Referencing how the asset will rally to the other end of the resistance is called the ‘’end-to-end move’’ as Olszewicz remarked:

“One-week Ethereum chart. End to end to $750 triggers within the next few months probably.”

Backing the positive technicals, there are some fundamentals that are in favor of the Ethereum bulls as an analyst said. Ryan Watkins, a research analyst at the crypto data company Messari, said:

“In short, Ethereum is being used more than ever, and in just two years, Ethereum has evolved from a blank canvas to an agglomeration of novel forms of value and use cases.”

The increased usage of the underlying blockchain is quite positive for ETH because according to the analysis, the transaction fees that the ETH miners get are linked to the movement of the cryptocurrency. If ethereum usage spikes, so will the underlying asset. Analysts are also becoming more bullish on Bitcoin. This could make Ethereum and Bitcoin closely linked as the rallies will help both the assets. Bitfinex’s order book data shows that there’s clear support of the $9,500 level which is important as order book data was critical in predicting the swings in the price of the cryptocurrency in recent years. The charts also show that the order book data supported Bitcoin when BTC was trading in the $4,000 back in March while nailing the $10,500 highs that were seen over the past few weeks.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post