Ethereum NFT sales see their trading volume sinking in July amid the ongoing bear market while Solana NFT trading slowed even more so let’s read more today in our latest cryptocurrency news.

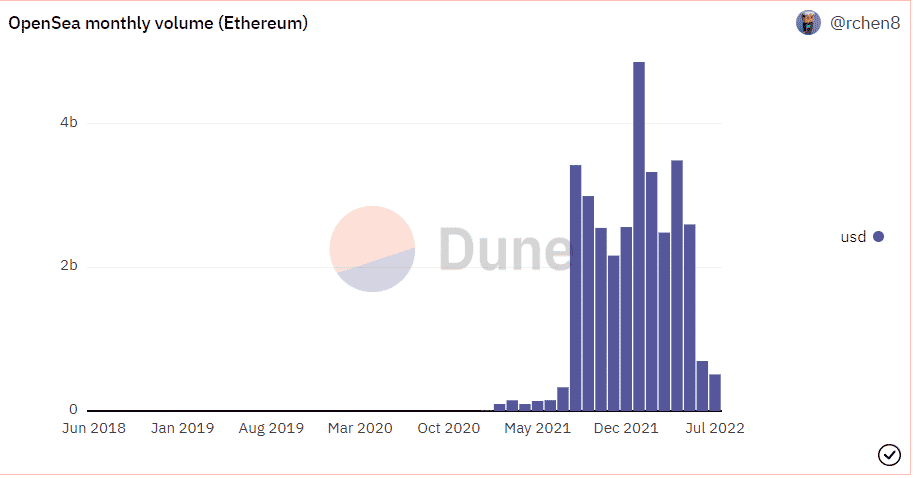

The leading market OpenSea posted small month-over-month gains in the total NFTs sold and the unique users but the overall USD sales volume declined. The data suggests that the NFT trading across Solana marketplaces cooled so far compared to June and as July ends, month-to-month data from OpenSea suggests that the Ethereum NFTs are selling at the same rate amid the bear markets with both the sales tally and the number of unique users remaining steady compared to June. The total USD value of the ones sold NFTs fell dramatically once again.

The data from Dune Analytics shows that 1.61 million ETH NFTs were sold so far compared to 1.54 million for all of June, while the number of unique traders increased from 393,000 to over 400,000 in July. Despite more users transacting on Opensea and buying more collective NFts overall, the value measured in USD dropped and Dune shows that more than $495 million worth of ETH NFT volume compared to the $695 million across June.

There is a 29% month-over-month drop in the sale volume measured in dollars so if the recent daily trading continues, OpenSea will finish the month with $530 million worth of ETH trading volume that will mark a 24% month-over-month decline. The Ethereum NFT sales saw the volumes drop and the market produced $25 billion worth of trading volume in 2021, adding $20 billion more worth of organic trading in the first half of 2022.

OpenSea is not the only marketplace in the ETH space but it is the biggest in terms of organic trading volume about 82% of the figure during the ending week of July. It provides a sense of trading trends on ethereum by far the biggest blockchain network for NFTs in terms of the trading volume.

buy cenforce online https://cleanandclearadvantagerecovery.com/wp-content/themes/twentytwentyone/inc/new/cenforce.html no prescription

The marketplace LooksRare and X2Y2 are known for being able to host large amounts of wash trading that were sales made at artificially inflated prices between linked wallets in order to earn trading rewards.

Data from CryptoSlam points to an average USD sale price of $451 per Ethereum NFT on marketplaces so far this month and both figures are lower than the preivous months. This has so much to do with the falling price of ETH as it has with the individual NFT prices.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post