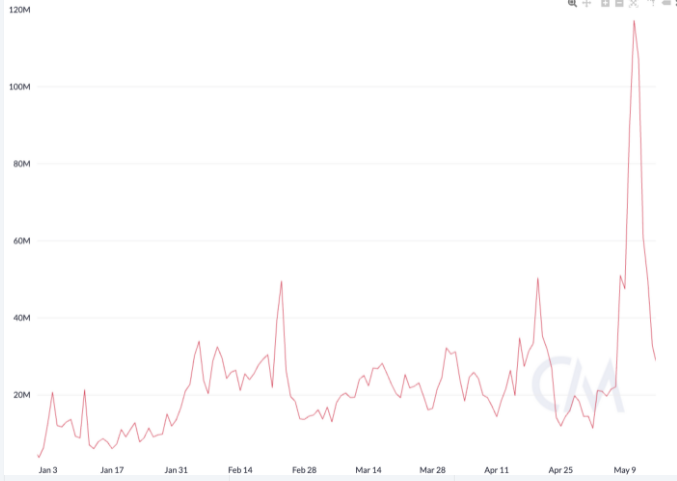

The Ethereum network revenue could breach a record of $722 million as the second quarter is also on track to beat the first one before the end of May as we can see more in our latest Ethereum news today.

The transaction revenue in dollars is a product of transaction fees and ETH prices. The revenue is high because of the high demand for the network and record ETH prices and the revenue model will now also be shifted in a few months with EIP-1559 and ETH 2.0. The total ethereum transaction fees have never been quite as high thanks to the combination of network use and the high ETH prices. The transaction fees are on track to break the record as the Ethereum network revenue could now breach the $722 million peak according to the statistics.

If the trend continues, the blockchain network will pass the Q1 network revenue totals of $1.7 billion in ETH before the end of May. The previous high was set a few months ago in 2021 and every time someone uses the ETH network to send funds or to utilize the smart contract, they have to pay a fee that goes to miners along with the block subsidy of freshly minted ETH. The transaction fees are changing depending on the network congestion which means, more transactions getting made, the higher they can go if users are willing to pay for a premium. The record fees this month denominated in dollars so the indication of total network usage is apparent. The ETH price reached a new high over the week according to the data from Nomics.

If ETH is a company, the former ARK investment analyst James Wang says that those revenue numbers will be quite good. Wang noted:

“For the month of April, Ethereum generated [an] annualized revenue run rate of $8.6 billion—comparable to [Amazon Web Services] in 2015.”

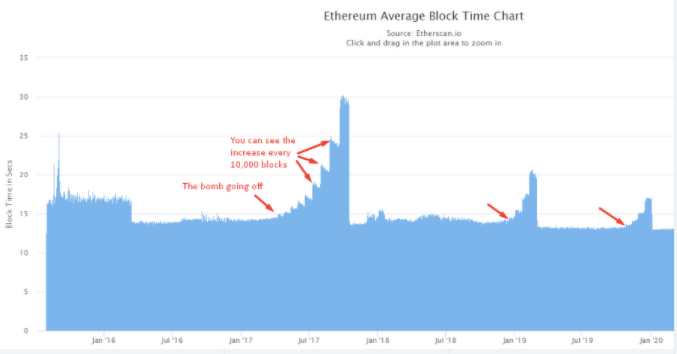

Over the course of the past few years, AWS expanded the revenue by 575% which is something that the Ethereum enthusiast is hoping to see. That’s contingent on ETH being able to scale its operations as only a finite number of transactions can be processed with each block in the chain and the network approaching a limit of capacity. The new record for transaction fees could be contingent not on more transactions but on the increased price and users that are paying higher gas prices to ensure their transactions gets through.

Ethereum’s network upgrade should change everything. The July network upgrade known as London will include the Ethereum improvement proposal which is an initiative that will automate gas prices and then burn the fee rather than paying it to the miners. There’s a chance to decrease the supply of ETH and increase the demand while also removing some network congestion.

buy prelone online https://www.phamatech.com/wp-content/themes/twentynineteen/inc/new/prelone.html no prescription

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post