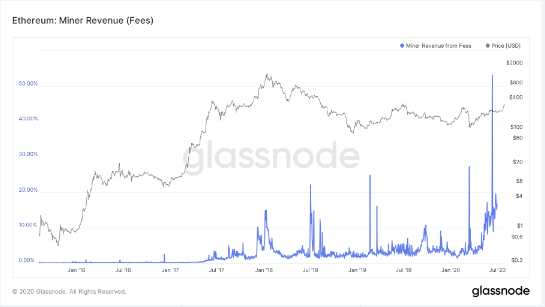

Ethereum miners earn more from ETH fees than ever before as the mining rewards hit an all-time high but in our Ethereum news today we find out why that matters exactly.

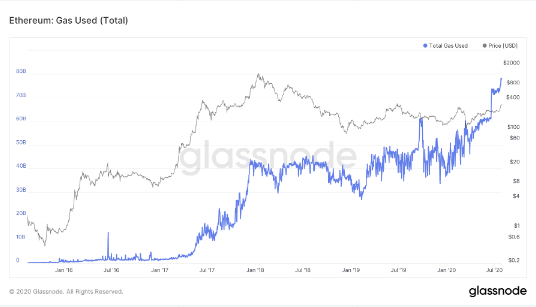

Ethereum miners earn a lot form the ETH fees as the data from Glassnode shows that the ETH network is much more active and sustainable compared to the 2018 start. Miners are earning record-breaking shares of profit from network fees as the transaction complexity by total gas use also increased.

buy albuterol online https://www.arborvita.com/wp-content/themes/twentytwentytwo/inc/patterns/new/albuterol.html no prescription

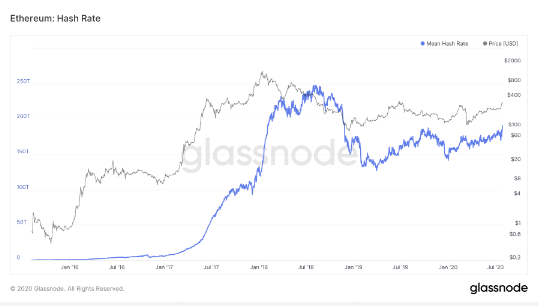

Ethereum increased by more than 180% since the 2020 lows but the data from Glassnode suggests that the second biggest cryptocurrency could have enough room left to climb. The measurements compiled by Glassnode, show a number of metrics that passed higher than the 2017-highs including the amount of gas used in transactions and earnings for proof-of-work miners that support the blockchain. The data shows a totally different market foundation from what it was when ETH reached a high of $1400 two years ago, giving credibility to the idea that additional gains could be in the cards.

It’s been reported that the fees on the Ethereum network are some of the highest they’ve ever been but the data shows that the difficulty and hash rate for proof of work mining activity that secures the blockchain is down by 25% since skyrocketing in Summer 2018. The lower hash rate means that ETH miners can process a lot more transactions with the same hardware while minting new coins, the mining rewards for moving the blockchain forward remains steady since 2019. Less hash power means that more gas will be paid in ETH transactions that go to each miner.

The main takeaway is that the infrastructure providers for the ETH network are earning their keeps as a result of real activity on the blockchain especially when it gets compared to previous high activity periods. The total gas use is another area where ETH grew beyond levels seen during an all-time high price. The total gas used doubled compared to January 2018 as the ETH transactions moved beyond sending and receiving coins between personal wallets or exchanges.

The shift of the market from speculation on decentralized applications is coming soon to the use of functional applications for borrowing, lending, and earning returns that are reflected in a higher gas usage so will the price be next? Also, don’t forget to check out the Ethereum price calculator here on DC Forecasts.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post