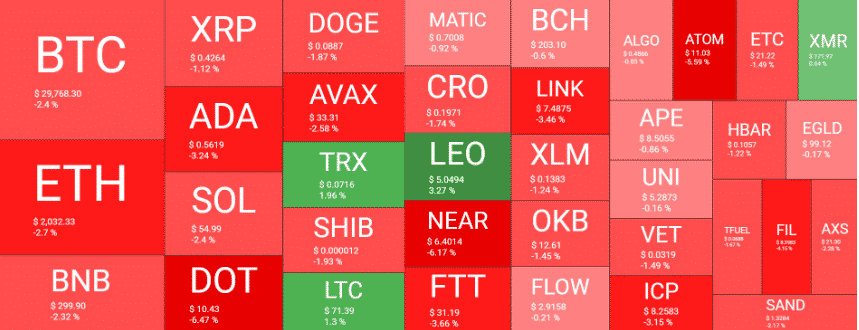

Ethereum has a hard time remaining above $2K while Bitcoin slipped below $30,000 and most of the other altcoins are in the red so let’s read more today in our latest altcoin news.

Bitcoin failed at overcoming $31,000 and it retraced by over $1000 to a familiar ground of $30,000 with most other altcoins being in the red today and Ethereum had a hard time and was fighting to stay above $2000. Polkadot lost the most from the bigger cap altcoins. Last week was a wild rollercoaster ride for almost every cryptocurrency but Bitcoin crashed by $15,000 and hit a multi-month low of $25,300. after recovering around $5000 in the next few days, the environment changed and this week it got quite calmer.

The biggest price increase came two days ago when BTC surged to beyond $31,000 but then failed and reversed the trajectory, coming back below $30,000. something similar happened yesterday when BTC traded above the coveted level for most of the day the cryptocurrency is now below this line but its marekt cap is down to $570 billion and the dominance around the altcoins remains still at over 44%. The alternative coins mimicked Bitcoin’s performance to a larger extent in the past few days with some strogn drops a week ago but with a calmer outlook since the weekend.

Ethereum tried its hand at $2100 but failed and the rejection drove it back to $2000. Binance Coin hit $310 but sits $10 lower after a minor decline. Similar decreases were seen from Cardano, Dogecoin, ripple, Solana, and SHIB. Polkadot lost the most in the past day and a 6.5% drop pushed DOT to over $10. TRON and Litecoin were among the few coins that had minor increases while the market remained stagnant and lose $1.3 trillion.

As recently reported, The Ethereum gas prices surge and they could double once again today, as per the data from Etherscan. Most of the causes for the increase are the transfers involving the addresses of the centralized stablecoins, USDC and Tether. The Tether stable coin transactions accumulated the most fees in the past day and are besting the trades on Uniswap as well as 1Inch where the stablecoin ranks fourth. Gas is measured in gwei and quantifies the computational power required to make the transaction on the ETH network. While the drop inv value of ETH is now under $2000 for the first time since July 2021, It brings transaction fees down in dollar terms and the amount of activity on the network is causing the price of gas in USD to travel upwards.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post