Ethereum fees increase by 500% thanks to the influx of users on the network, because of the growth in the decentralized finance sector. The past few weeks were quite strong for the ETH adoption as we saw a spike in users, transactions, and addresses.

However, as per the reports from one of the best cryptocurrency news sites, the daily median gas price of Ethereum transactions surpassed 50 Gwei which is five times higher than the one in April, and the highest in almost two years. While some could see the increased usage as bullish for Ethereum, others are not so sure this is the case. Some analysts believe that the high transaction fees can be the cause of a price drop in the longer run.

#Ethereum gas prices continue to rise.

The daily median gas price has increased by more than 5x since April, surpassing 50 Gwei yesterday for the first time in almost 2 years.

Live chart: https://t.co/jAzTVXZoVy pic.twitter.com/nN2ToIOuZE

— glassnode (@glassnode) July 17, 2020

Qiao Wang, the former head of product at Messaari and analyst, said:

“So long as ETH 2.0 is not fully rolled out, there’s an obvious opportunity for a highly scalable blockchain to dethrone Ethereum. Paying $10 transaction fee and waiting 15 seconds for settlement is just bad UX.”

I've changed my mind after using a dozen of Defi platforms. So long as ETH 2.0 is not fully rolled out, there's an obvious opportunity for a highly scalable blockchain to dethrone Ethereum. Paying $10 transaction fee and waiting 15 seconds for settlement is just bad UX. https://t.co/vXAAFET3YK

— Qiao Wang (@QWQiao) June 28, 2020

It’s not only Wang that saw the increase in gas fees threatening the viability of ETH as an investment. The CIO and VP of Portfolio Management Steven McClurg and Leah Wald also commented:

“The issues inherent in gas costs have created congestion, which is a negative network externality. Congestion on Ethereum has led to poor user experience, especially for traders in this highly volatile environment, as their leveraged positions may be liquidated before they can act.”

Joseph Todaro also noted about the transaction fees skyrocketing and making the network less scalable once again:

“For awhile the dark horse goes unnoticed. It doesn’t yet have its army of shillers who will provide warm feelings of confidence and certainty of success. But they are coming. […] It is time, once again, to look at the neglected and scorned ETH competitors.”

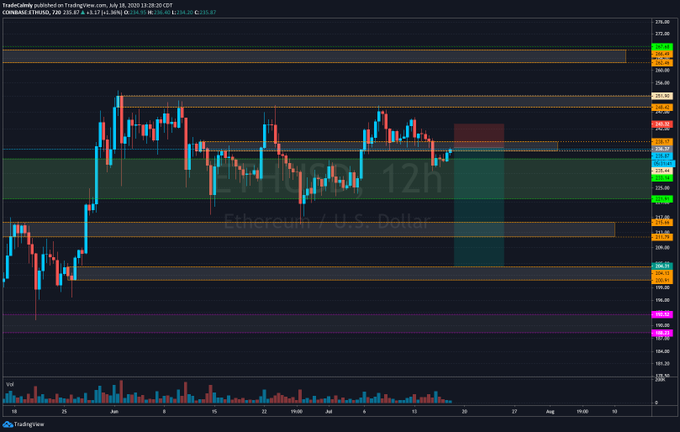

There’s also a bearish technical case for the asset as Ethereum fees increase 500%. One trader even shared a chart showing that the leading cryptocurrency remains below the crucial resistance level and that it is time to go short on ETH.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post