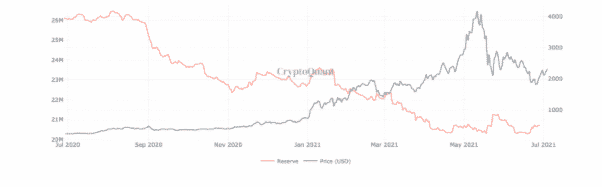

The ethereum exchange reserves drop to a two-year low and according to CryptoQuant, the number dropped from 26 million from June 2020 to less than 21 million by July 2021 as we are reading more in our latest ethereum news.

The drop seems to be in tandem with the increase in the price of ETH and over the past few months, the price of ETH has gone up and the Ethereum exchange reserves drop to a new low. Exchange reserves are the available supply for selling, margin trading, and altcoins purchasing on exchanges and now, there are less and less of the amount available on the exchange. With the announcement of ETH 2.0 came a new ability for investors to stake their coins and to get returns on them. Ethereum moving from proof of work to proof of stake meant that the network will not need validators. Validators are the medium of confirming transactions on the PoS network. This means that people could run their own node.

It only takes up to 32 ETH coins to be able to run your own node and to become a validator so with this, more investors are taking the option of staking themselves and this method is meant to bring more safety since you have access to your own private keys while still staking. As long as you know what you need to do. This means that the users are now taking their coins out of exchanges and put them in their own private wallets so as long as they have enough coins, they can set up their own nodes and can stake their coins on their own terms.

This left the investors with a lesser amount of coins leaving the coins on the exchange. The exchanges lost over 5 million coins collectively from their reserves in a year. And it is expected that the number will continue as more investors get into staking. A staggering 6 million ETH was staked in ETH 2.0 and the number of validators in the network surpassed 179,000 and counting. However, if something happens on the exchange, you could somehow end up leaving your coins to attackers and this is why long-term holders don’t leave coins on an exchange. Coins are only left on exchanges to be traded or used so investors transferring their ETH coins to wallets they control could account for some of the drops in exchange reserves.

As more people understand how the markets work, they know the best way to save your coins and this is to put them in a wallet where you can have full control of the keys. Wallets like Ledger give you seed phrases when you acquire your wallet and users can write their seeds down and you can be the only one that has access to them.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post