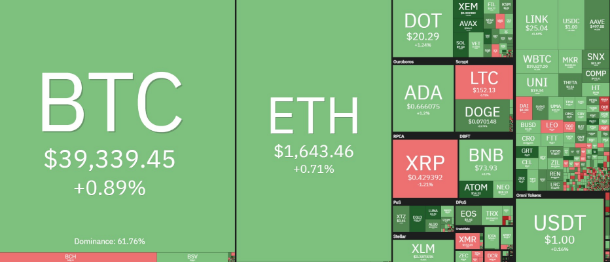

Ethereum crashes before CME launched ETH futures by 10% at a price of $1513 that coincided with the overall market slide. Bitcoin fell by 7% in the past day to $37,547 while XRP crashed by 10% to $0.39 so let’s read more in today’s altcoin news.

The price of ETH crashed by 10% and the price is now trading at $1513 with the downward trend starting at the price point of $1626. The market tanked later and hasn’t yet recovered. Ethereum crashes before CME launched the ETH futures trading options while they are considered to bring plenty of money to Ethereum because it comprises an efficient and regulated way for institutional investors to speculate the future price of the coin.

It could be the case that the traders started exiting their positions ahead of the listing and CME’s ETH futures contract are making it easier for institutional investors to short ETH and bet against it. CME launched BTC futures back in 2017 the day after Bitcoin hit its highest price of $19,015. After that, Bitcoin crashed and ended its bull run. With that said, 2021’s crypto market doesn’t look like 2017 at least because we don’t have the scammy ICOs anymore. One trader commented:

“A retest of $1,550 was always going to happen, with or without CME.”

Ethereum’s crash coincided with the entire market slide while BTC fell by 7% over the past day to $37,547, XRP crashed by 10% and Polkadot crashed by 8% to $18.7. Other crypto assets remained strong like Cardano for example that is worth $0.58 marking an 8% increase in the past day with Dogecoin increasing 35% in the past day and 116% in the past week. The crash could be as simple as a market correction but the price hit an all-time high of $1756 a few days ago and hit similar prices yesterday.

When crypto assets hit a new peak they retrace their steps in the upcoming days. BTC hit $42,000 last month now retreated to $31,500. These dips could occur because a certain price triggers the traders to sell their positions and this dump causes a price crash. Some traders see opportunities in the dip and hope that the market will bounce back, as one trader said:

“Feel like I need to take the plunge. I’ve been delaying this decision ‘for a better time.’

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post