The Ethereum congestion is likely caused by a Forsage Ponzi scheme and not DeFi as everyone believed so in our ethereum news today, we will try and find out more about it.

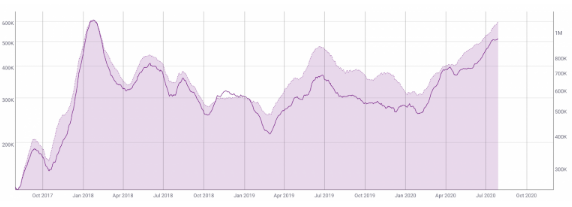

The transaction and gas costs on ETH surged in 2020 and this increase coincided with the DeFi craze but now the data shows that the main reason for the ethereum congestion was something else. The Forsage Ponzi scheme drives the transaction fees up because of the extremely high costs of the registration procedure. This year is officially the year of DeFi but while the top Layer 1 blockchains compete for uses in the sector, ETH remains the king. The surge in daily active addresses and transaction fees on ETH suggests that DeFi is pushing up the network to its limits.

While the network’s congestion brought Ethereum’s scalability problem back to the table, the huge demand for DeFi is favorable for the development of the system. Now, the new data shows that the Defi was actually not the main reason behind the clogged network. On the website, Forsage says it is an “international crowdfunding” platform but it doesn’t showcase projects that try to raise funds. Instead, the users can see how much partners can earn through their referral tiers. Looking at the team info about the project, there are no founders or team members but they only claim to belong to the community.

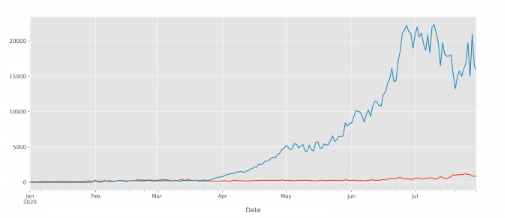

The videos on the website promise daily payouts in ETH which proves that Forsage is surely a Ponzi scheme. The platform played a crucial role in distorting the organing Dapps usage for ETH. The project ranks first by user number and the transaction number, leaving the closest competitors behind. Looking at the on-chain data reveals calls to the smart contracts of Forsage which started to pick up in Q2 this year, outpacing top-performing decentralized exchanges.

While Forsage is far from being a top-performing Defi app such as Compound, it doesn’t mean that its impact on the network is marginal. The transaction costs on ETH don’t actually depend on the sent amount as much as they rely on the operation type. The transfer between two accounts costs quite cheap with the current high Gas prices. On the other hand, interactions with smart contracts require high computationally-intensive tasks that pay more Gas than it is consumed for transacting.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post