Ethereum becomes the world’s most used blockchain with the rise of the DeFi use, surpassing Bitcoin, as we are reading more in the upcoming Ethereum news today.

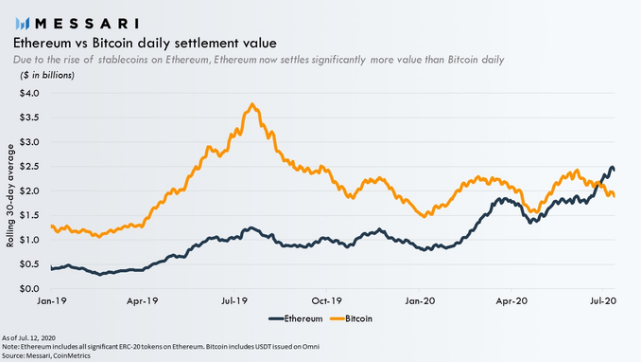

For the past month, Bitcoin’s price was trading in a tight range and the trading volume was relatively flat. In the meantime, a few tokens on the Ethereum network were topping the price charts especially all of the DeFi tokens. New data from Messari shows that Ethereum becomes the most used blockchain, surpassing Bitcoin as the network that settles most value per day. This means that the dollar value of transactions of both Ethereum and ETH is higher than the one of Bitcoin. While the DeFi sector started gaining a lot of popularity, the stablecoin transactions were responsible for most of the volume, reaching $508 billion in transactions in 2020. This figure is about the double of $254 billion back in 2019.

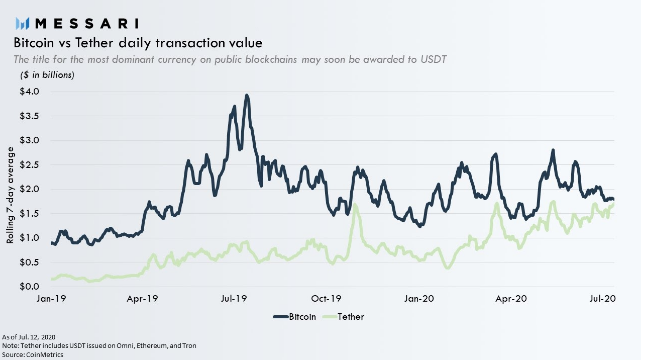

Tether’s USDT is the main stablecoin that is responsible for the volume according to Messari which could surpass Bitcoin as the most transacted cryptocurrency on the market. Bitcoin offers colored coins through Omni and Counterparty but these assets are not doing well compared to the smart contract coins on the ETH network which continue to skyrocket thanks to the novelties in the DeFi sector. Coupled with the lower fee options and faster transaction times, ETH became the chain of choice for decentralized and centralized stablecoins.

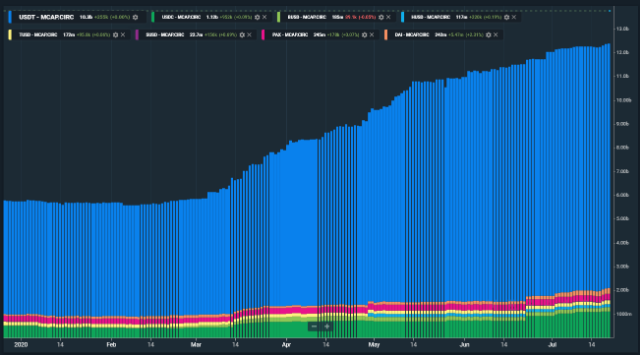

USDT was first issued on the Bitcoin blockchain but now, 13% of the supply resides on BTC while there are 59% of USDT on the Ethereum chain. Most of the USDT balance is held on Ethereum and USDT is the biggest spender of gas on the network according to the data from Gas Station. The overall stablecoin market capitalization increased from $2.4 billion to around $8 billion in Q1 alone. Another $3.8 billion was added in the second quarter, reaching $12 billion and $9.18 belongs to Tether. USDT also surpassed Ripple as the third-largest cryptocurrency.

While the inter-exchange settlement is the most popular use for stablecoins, Defi is also a strong force in the growing activity that is seen on the ETH network. Because of the peg to fiat currencies, stabelcoins are extremely popular among DeFi lending protocols which are gaining a lot of traction in 2020. The platforms that saw the most surges in the number of funds were locked in Q2 surged above $2 billion as Compound alone reached $1 billion assets borrowed in total.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post