The ETH TVL dominance drops to 55% while its price has been increasing alongside Nasdaq, but there’s a catch and we see more about it in today’s latest Ethereum news.

Another big drop in the US Stock market can leave ETH in a downside spell according to reports. Mike McGlone, the senior commodity strategist at Bloomberg, anticipates the US Equities to face downside pressure against a prospect of an energy price spike and the ability to invoke a 2008-like glboal marekt recession:

“The war in Ukraine and spiking crude make a potent combination for a global recession.”

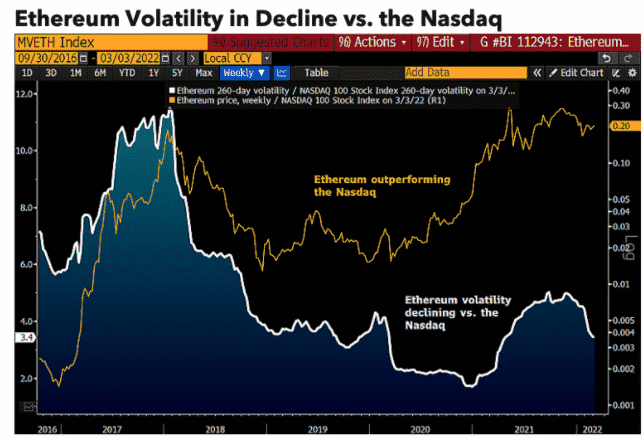

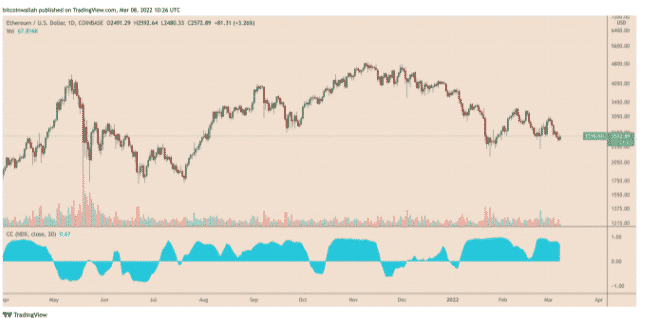

The correlation between the US stocks indexes and the top cryptocurrencies increased in the ongoing market crash amid the Russia-Ukraine conflict. Ether’s correlation efficiency with tech-heavy Nasdaq increased to 0.

buy furosemide online https://hiims.in/kidneycare/assets/fonts/flaticon/new/furosemide.html no prescription

93 a few days after Russia invaded Ukraine but then corrected to 0.67 while an absolute value of 1 means that two assets move perfectly in tandem.

McGlone spotted the ETH TVL dominance dropped while the price is trading in the middle of the range according to its 100-week exponential moving average. He expects major selling pressure at the interim resistance level of $4000 and wrote that the graphics depict Ethereum at about the middle of the range and if the stock market takes another leg lower, ETH is more likely to revisit the lower end of $2000:

“If equities drop fast, Ethereum could repeat last summer and revisit about $1,700.”

The latest data shows that Ethereum’s market dominance is giving up rounds to competitors like Cardano, Avalanche, Solana, and Terra. The share of the ETH TVL dropped below 55% which is the lowest level on record from 97% at the start of 2021. The researcher at Messari Tom Dunleavy noted that the layer-one blockchains are many asters, cheaper, and provide an attractive reward structure. He also added that overtaking Ethereum and Ethereum virtual Machine’s software platform to create dapps will be hard because of the first-mover advantage:

“The EVM’s advantage has been so great that major competitors use or bridge to the EVM, rather than try to compete head-to-head without this capability. Even competitors that held out like Solana and Cardano have recently added or are adding EVM compatibility (Terra being the notable exception). In many cases, the EVM has already cemented itself through its network effects.”

However, not everyone expects Ethereum’s TVL market share downtrend to continue. Another analyst Marcus Sotiriou anticipates that Ethereum will regain its dominance as it switches to PoS later this year from its current PoW protocol.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post