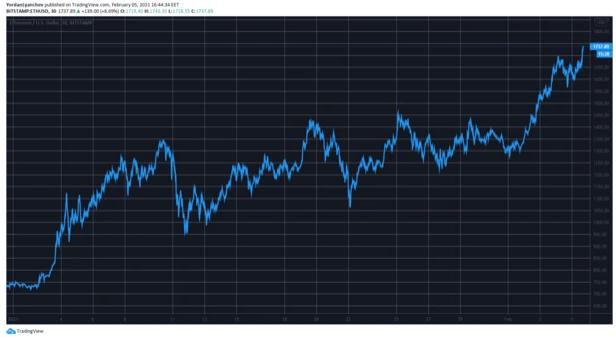

ETH trades near a new all-time high before correcting lower against the US dollar and could find a strong support near the $1500 level as we read more in today’s Ethereum news.

ETH trades near a new all-time high of $1750 before it corrected lower against the US dollar and the price trading below the $1650 but it got above the 100 simple moving average. There was a break below the major contracting triangle with support of $1660 on the 4-hour charts of the pair that could revisit the $1500 support levels where the bulls will remain active.

Over the past week, Bitcoin and Ethereum saw a steady increase above $1500 and $36,000 respectively against the US dollar with ETH trading to a new all-time high close to the $1750 level before facing a strong selling interest. The price started a downside correction and traded below $1700 and the 23.6% fib retracement level from the upwards move from $1274 swing low to $1750 high. The pair managed to break the major contracting triangle with support at $1660 on the 4-hour charts of the pair.

The price is trading below the $1650 level but it is well above the 100 simple moving average. The next major support is close to the $1500 level and the 50% fib retracement level from the upwards movement from the $1275 swing low to the $1750 high. More losses could open the doors for another decline to the $1440 support level and the 100 simple moving average which is also near the $1440 level that will act as strong support. If ETH remains stable above $1500 it could start another increase with the initial resistance on the upside set at $1700.

The next major resistance near the $1750 level will await if a clear break above the $1700 resistance level is broken as it can open the doors for a strong increase and the price could climb above $1800 and $1850 level in the near-term. The MACD for the pair is gaining momentum in the bearish zone while the 4-hour RSI is just above the 50 level. The first major support level is set at $1500 while the major resistance level is set at $1700.

As reported earlier, The DeFi projects and stabelcoin usage boosted Ethereum’s gas fees to a record level and with the ETH’s increasing price, it only got worse. The transaction cost paid on the network prompted the Defi and the stablecoins to surge to a new high of over .

buy lipitor online https://www.arborvita.com/wp-content/themes/twentytwentytwo/inc/patterns/new/lipitor.html no prescription

It’s not a secret that the community uses Ethereum as the most utilized blockchain but it did struggle with scaling issues for quite some time.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post