The ETH testnet burned 88K of coins to prepare for the EIP-1559 as the long-awaited upgrade for Ethereum is getting closer and closer so let’s read more in our latest ethereum news today.

The long-awaited upgrade for Ethereum is getting closer as the hard fork launched on the Ropsten testnet in preparation for the mainnet rollout in July and the upgrade will bring even more of the implementation of the highly anticipated EIP-1559 modification that will adjust the transaction fee calculation mechanism:

“Ropsten in #London!

Welcome #EIP1559https://t.co/oKhEMR83fz— Nethermind (@nethermindeth) June 24, 2021”

The next phase in the hard fork rollout is the deployment of the Goerli Testnet which is scheduled for June 30 and after that, it will be launched on the Rinkeby testnet and then on the mainnet later in the month. As a part of the EIP-1559 mechanism aside from changing the fee auction structure, is to burn the base fee which will make the entire economy deflationary over time. The new website called Watch the burn was set up to track this action and at the time of press, 88,483 ETH were burned on the testnet which is equivalent to around $177 million at today’s prices.

ETH software solutions company Consensys estimates that the annual supply change will be minus 1.6 million coins and at current prices, it equates to the burning of $3.2 billion in ETH that will reduce the supply rate by 1.4%. The deflationary properties of the network will be compounded even further when the proof of stake launches on the mainnet for ETH 2.0 next year and the asset isn’t getting mined anymore.

The predictions Global founder Ryan Berckmans detailed how the prices will surge to five figures through these deflationary mechanisms and argued that this effectively gives ETH back to holders and not the miners as the asset increases in scarcity through fee burns. The hopes however of major gas savings from the upgrade were dashed and ConsenSys confirmed that it was not the goal of the EIP:

“As a side effect of a more predictable base fee, EIP-1559 may lead to some reduction in gas prices if we assume that fee predictability means users will overpay for gas less frequently.”

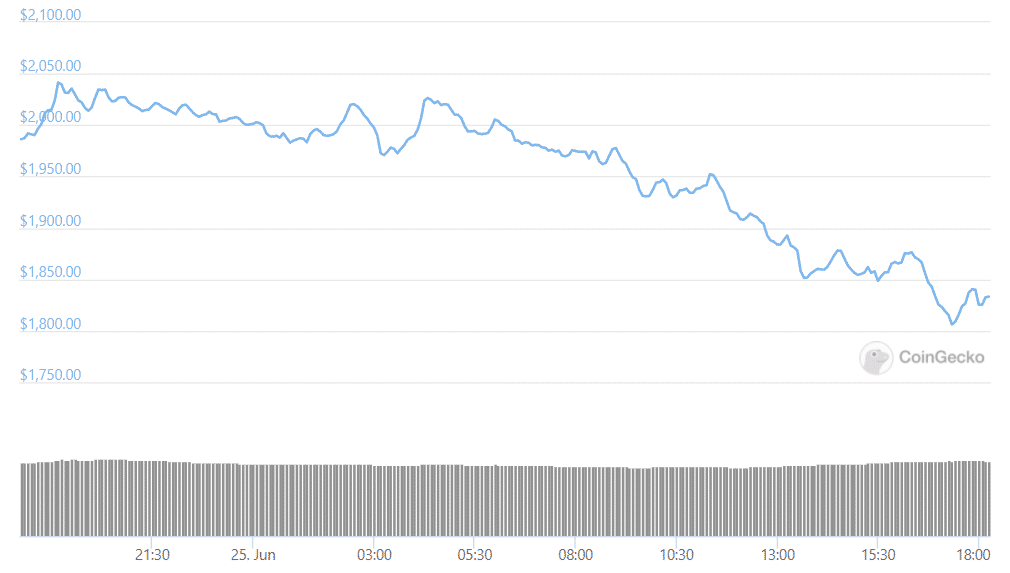

Ethereum prices regained their level at $2000 and the asset gained 4.2% on the day but still remains in a downtrend. CoinGecko reported a 20% decline in the ETH price over the past night and the world’s number two asset is now 54% down from its ATH of $4350. There could be another waiting game to see what happens before the properties of scarcity and demand are reflected in the price action.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post