The ETH price action could see some explosive movement as the Ethereum OI Options surge, as we are reading more about it in the latest ETH news.

In recent times this has caused ETH to see some prolonged sideways trading action but it has also ended up working in the crypto’s favor over the past day and it was able to dodge the downturn that is seen by most of the altcoins. The cryptocurrency is now showing some signs of both technical and fundamental strength which led one analyst to believe that ethereum can start a sharp move towards $350. The ETH price action also indicates that the traders are widely expecting a strong movement to ensure in the upcoming weeks and months.

Despite the increased volatility today, Ethereum remains caught up in the macro trading range between $230 and $250. The second-biggest digital asset has been respecting these levels as a support and resistance and now seems to be preparing up to test the upper boundary of the range. At the time of writing, Ethereum is trading up over three percent of the current price of $244. This marks a huge climb from the recent lows of $230 which is where it was consolidating at over the past week.

Today’s move comes in the face of immense turbulence amongst bother altcoins which many of them trading down as five percent. One analyst noted that he believes Ethereum could target $350 in the near-term and in the recent blog post, the analyst explained that he believes a clean break above $244 in the hours ahead and could start a rally that allows it to a fresh high in 2020:

“This $242/244 resistance level has been a significant resistance level for price action for some time now… This should give bulls the momentum to get a clear test of $350.”

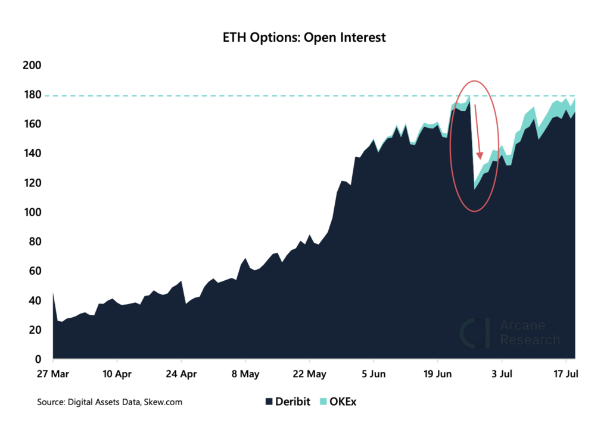

He added further that there are signs of accumulation while looking at the high time frame price action. Ethereum’s options market seems to be expecting to see some huge volatility. According to a report from Arcane Research, ETH’s options market now has an open interest of $180 million and is on the edge of starting a fresh all-time high. The fast recovery from the ETH options OI from the monthly expires in June, indicates that the traders are expecting the cryptocurrency to see huge volatility. As OI in this fragment continues to grow, its influence over ETH’s future price action will grow larger making future contract expiries important to look after.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post