ETH miners raked about $300 million last month as the hashrate broke new highs and the DeFi boom brought a rush of ETH miners with hashrate making an all-time but will it be sustainable? Let’s find out more in our Ethereum news.

Ethereum mining hashrate reached an all-time high of 250 TH/s and the parabolic increase coincide with the boom in DeFi. The growth could be temporary with proof of stake implementation planned for the ETH 2.

buy aciphex online https://nosesinus.com/wp-content/themes/twentytwentytwo/inc/patterns/new/aciphex.html no prescription

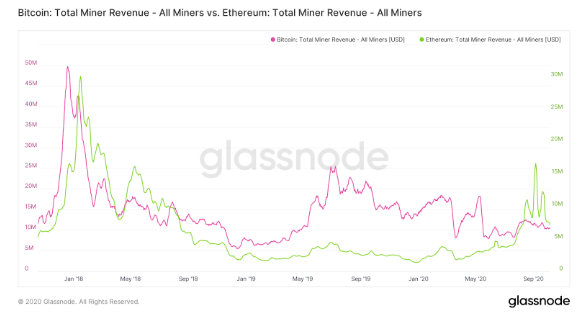

0. Ethereum’s hashrate surged to a new all-time high marking an 80% increase since the start of the year but the replacement of the Proof of Work protocol along with the decreased earnings for the miners are really questionable for the sustainability. The increase of ETH’s hashrate coincided with the yield farming craze in DeFi but it’s not only the hashrate that increased. The ETH miners raked $300 million and they are now making more money than BTC miners.

The earning from the fees added to the block rewards for the mining of the coin during the last quarter. On the day of the UNI token launch, about 70% of the miner revenue was actually earned from the fees. Since the halving event happened, the BTC miners made about $10 million per day securing the network. ETH miners were stacking fees until reaching a peak of $16 million as more than half of the earnings were from fees. Before the DeFi boom, ETH miners earned about $2 and $3 million per day. The mining revenue for ETH miners witnessed spikes in the last quarter and is again reaching the same levels with BTC.

Ethereum’s mining industry could dissolve with the imminent launch of the proof of stake consensus mechanism on ETH 2.0 and the upgrade will place a smaller premium on the hardware and transition to the financial incentives to make sure that there’s trustworthy network participation. The cost to become an ETH validator is now 32 ETH which is about $11,000 at press time. Validators that will falsely validate blocks will get panelized with fees. Others that behave honestly, will be rewarded with a steady revenue stream.

According to the current hardware costs, the new miners will not find it economically viable to join the network. The most powerful GPU mining set-up according to F2pool will cost around $20,000 and with that profitability, the miners will make about $6,000 per year.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post