ETH killers SOL and AVAX dropped by 20% despite surging during the first half of 2021 and more people choose the alternative networks due to Ethereum’s inability to process a bigger number of transactions and high fees. In our latest Ethereum news, we are taking a closer look at the price analysis.

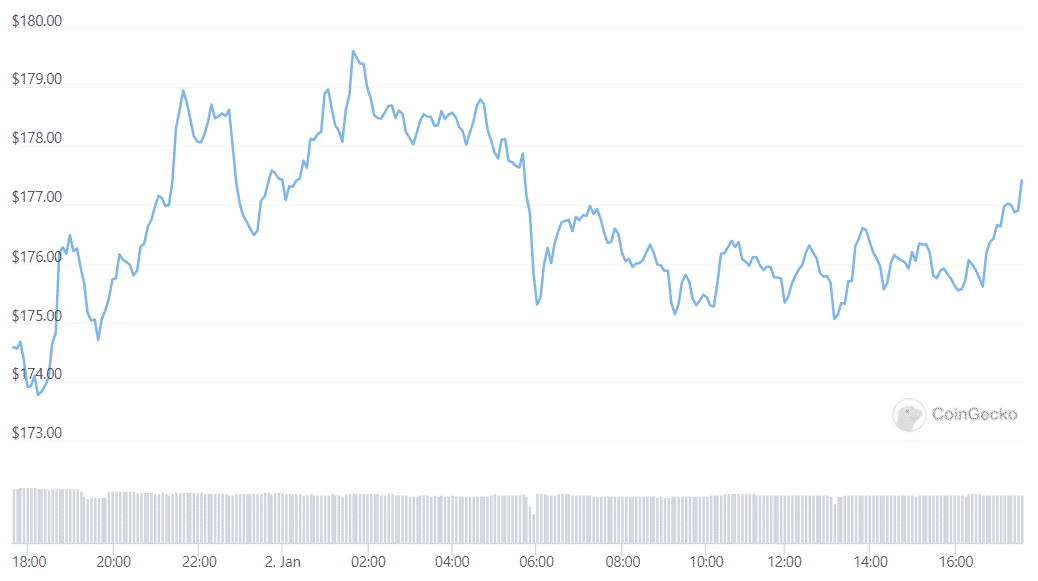

The ETH Killers SOL and AVAX dropped mainly because of the decreasing popularity of NFTs and decentralized finance. The alternative chains went down the same road as ETH by losing a part of their value. As per the trading view market data, Solana’s bull run was correlated with the rise and downfall of the NFT industry. For those that believe SOL is the real Ethereum killer, think again as the coin replicated Ethereum’s market performance and lost about 30% of its value since the all-time high in November.

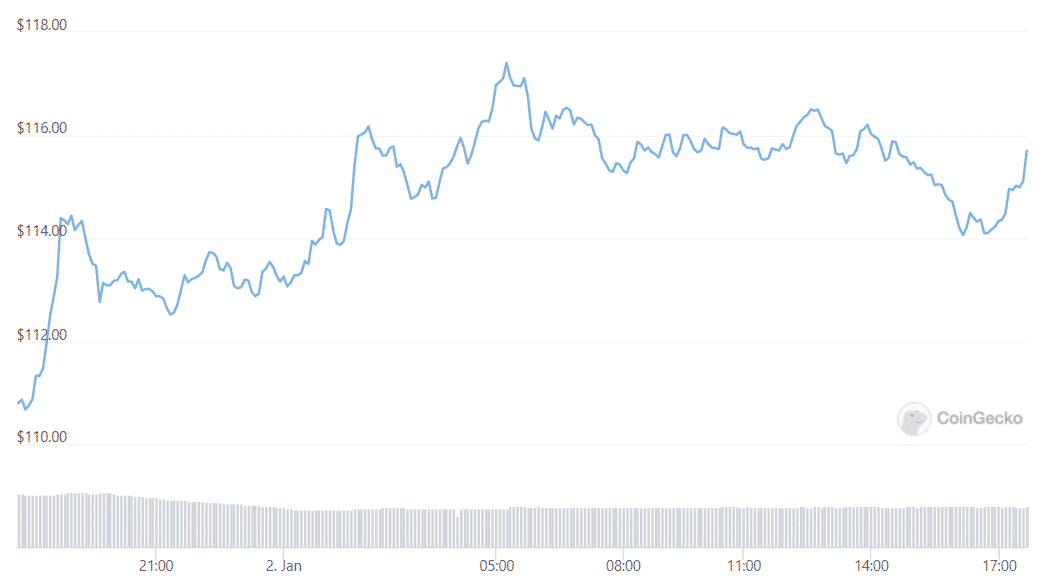

Avalanche’s AVAX was another Layer1 network that failed to maintain its value during the global crypto market correction and similarly to Ethereum it lost about 20% of the value in the past two months. Unlike Solana, AVAX showed its first signs of recovery earlier with a 14% price growth in the past three days. Compared to other L1s, AVAX showed strong performance during the market sell-off with about a 50% rally in the middle of December. AVAX is trading with 1.8% profit and it is moving up inside the local uptrend and Solana is still moving down with a 1.8% drop performance during the day.

As recently reported, Over the past five days, Avalanche earned a neutral rating sentiment score which measures the performance of Avalanche over the past five days by price movement and volume. The Sentiment score provides a short-term look at the crypto performance which can be useful for both short-term investors that are looking to ride a rally and the long-term investors who are trying to buy the dip. Avalanche is now trading near its midpoint and the coin is still 10.61% off its five-day high and it is 12.71% higher than its five-day low of $101. Avalanche’s AVAX token is trading near the support zone around $113 and it has a lot of space before hitting resistnace. Avalanche traded on low volume as of late which means that today’s volume is below the average volume over the past week.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post