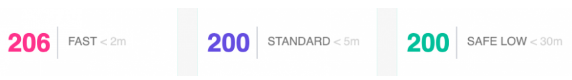

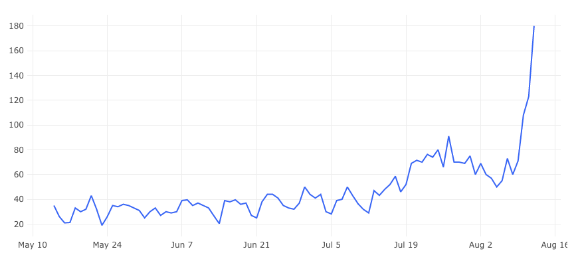

The ETH gas fees hit 200 Gwei as the DeFi supporters are falling in love with YAM today. However, the increase in gas cost can pose a systematic risk to the ecosystem and is holding back the usage of decentralized finance as we are reading in the ethereum news today.

Between ETH 2.0 and the second layer, the latter offers less negative trade-offs for the entire ecosystem. DeFi protocols, on the other hand, will lose a lot of potential users if the non-power users are not able to afford Ethereum. The ETH Gas fees hit 200 Gwei today, posing a huge threat to the mass adoption of Defi. Some previous moves to increase the gas limits didn’t do anything but enrich the miners of the networks. The push for layer two is seen as the most viable solution to reduce the costs of using ETH.

DeFi protocols rely on higher levels in order to generate fees and eventually profit for token holders. The transaction fees reached a threshold where the cost of using Ethereum is offsetting the profits. 200 gwei per unit of gas is the most expensive level ever. This is paving the way for Defi protocols on other blockchains such as Solana and Cosmos but the majority of the users and liquidity are still on Ethereum. Whales who account for most of the Defi usage, they have no problem paying $10 fees to swap the tokens or $20 to supply the market.

If Defi wants to steal the market share from centralized finance, cheaper costs are needed. The only real winners are Ethereum miners who are making tons of money by raising the income from fees. Total revenue to Ethereum miners increased over 1400% this quarter, pushing Ethereum ahead of BTC in terms of revenue. There is evidence that the miners themselves are spamming the blockchain with hundreds of transactions to keep the fees artificially high. Miners passed an increase in the gas limit which is not a real solution and this only increases the workload for those operating the nodes while putting money in the miners’ pockets.

The second layer solutions build a sub-network on top of the existing blockchain and to promise to bring transaction costs to low levels. DeversiFi and Loopring and a few other products exist on layer two ecosystems but they account for a smaller portion of total DeFi usage.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post