ETH garners momentum in one single day as it broke the all-time high level and saw a record in open interest by attracting huge amounts of institutional capital. But what’s the other reason behind ethereum’s rise? Let’s find out in our latest ETH price news.

Yesterday marked one of the biggest days for Ethereum as it saw $38 million in institutional inflows and a record day of open interest. one exchange also introduced a bullish option product. ETH had a huge day on the market as the asset hit an all-time high with its open interest reaching a high of $5 billion and Grayscale picking up over $38 million worth of ETH. The protocol is now the world’s most used blockchain in terms of on-chain value transfer and daily users with use cases ranging from sophisticated decentralized finance apps to non-fungible tokens.

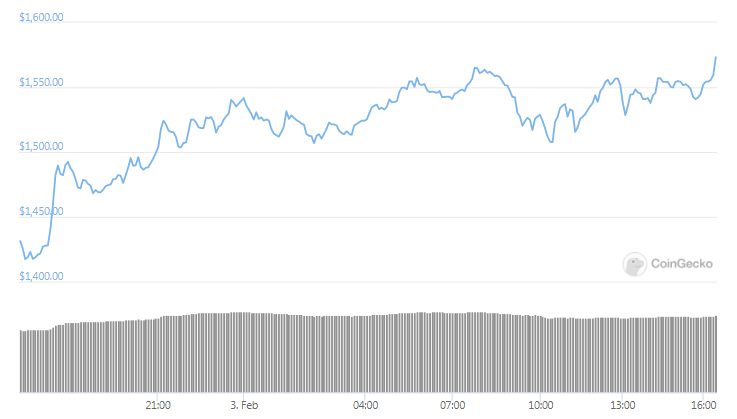

ETH is now trading at $1560 after a price surge from a day ago and it is now trading on its highest ever level recorded in its five-year history. The previous high was around 50 level back in 2018.

buy zithromax online pridedentaloffice.com/wp-content/themes/twentytwentyone/inc/en/zithromax.html no prescription

It’s not only the retail investors that are driving the prices up. Another report released by Grayscale shows that ETH’s trust product holds about $38 million and it reopened for businesses yesterday. This brings the total holdings above the $4.2 billion mark. Ninos Mansor who is a partner at Arrington XRP Capital said that the upcoming capitalists that are bringing the price up were the increasing adoption of DeFi apps and the huge amounts of the coin locked up in “Staking” as the blockchain shifts towards proof-of-stake consensus algorithm.

BREAKING: Grayscale adds 24,796 $ETH worth $37.8million over the past 24 hours.

— Crypto Rand (@crypto_rand) February 3, 2021

He added that the reopening of the trust was a “black hole” for the asset because most coins are getting locked for a longer period of time which means they cannot be sold to lower down the price. This could end up reducing the amount of liquidity on exchanges that is already dropping. As ETH garners momentum and prices rise, some traders think that they should bet on higher prices. The data from Skew shows the “open interest” on ETH’s futures increased about 40% and hit a total record of $5.4 billion.

The market is yet to understand Ethereum’s four-prong supply sink

Unlike the Halving, $ETH's supply-side argument is not straightforward to grasp

But once understood, just like the Halving, these dynamics will drive a quick institutional repricing 👇

— Ninos M (@ninos_mansor) February 3, 2021

This number means that traders haven’t closed their positions in thee anticipation of bigger price movements. Seeing the bets, the options exchange Deribit launched a new ETH contract which is an option that will see ach ETH sold at $25,000 and traders can also purchase this for a lower cost while gaining a huge amount if they are right.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post