The ETH fees hit multi-year high as over the past few weeks, the price of the asset stalled in terms of price action trading between $210 and $240. The blockchain activity of the asset also had a tough blow, as we are reading more in the following Ethereum price news.

Due to the storm of events, the number of users of the network increased and the blockchain analysts from Santiment reported that the number of new ETH addresses created per day, surpassed 100,000:

“Ethereum’s network growth metric has rapidly been on the rise since the beginning of 2020, creating 237% more addresses yesterday than it did on Jan 1, 2020 (and ~+200% accounting for rolling averages now vs. then).”

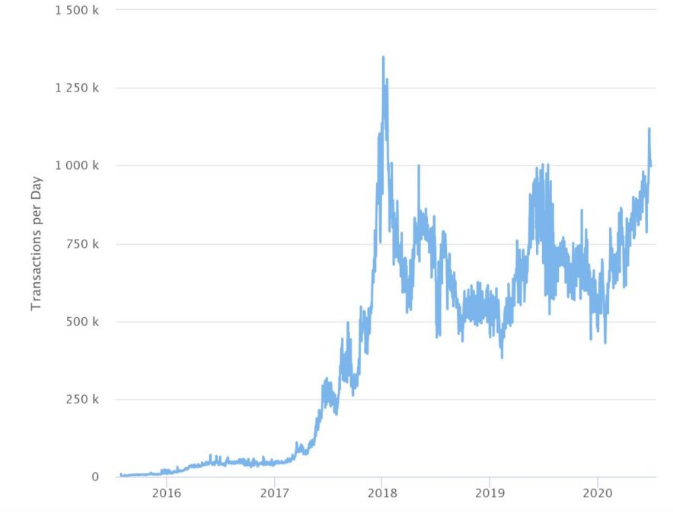

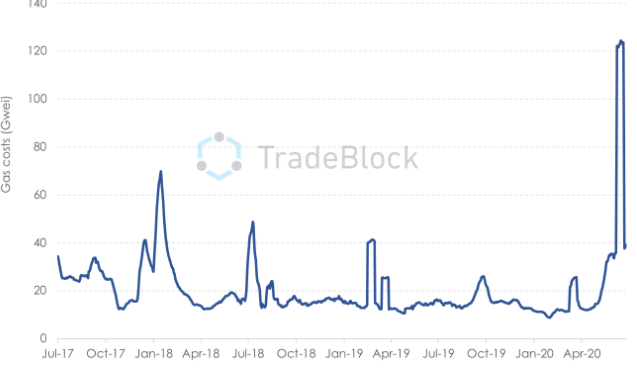

A similar trend of growth was seen in daily transactions and price action as well and as it can be seen from the charts, the number of transactions and ETH Fees hit multi-year high as there were 1.1 million transactions in a single day while the all-time high is around 1.37 million transactions in a day. The spike in usage didn’t come without a cost too. According to the data shared by Tradeblock, the cost of transacting on ETH hit highs that were not seen in over two years:

“With the rise in DeFi apps, majority of which are built on Ethereum, ether gas fees hit recent highs, meaning transaction costs across the network have risen in order for timely transactions to occur.”

Tradeblock’s data shows that the cost of one gas reached 120 gwei which is an increase of almost 50 percent from the 70 Gwei highs of the 2017/2018 bull market. The data from Etherscan on the other hand can be seen that the 120 Gwei fees were the highest since 2016. The head of Business Development at Kraken’s futures division, Kevin Beardsley:

“I have spent $14 on ETH gas fees to transfer/lock my $15 into @CurveFinance and I’m earning a princely $0.079 in weekly $SNX rewards. I’ll break even in just 177 short weeks! (not including gas to close contracts.”

Beardsley is one of the few that says it will cost $10 more to send a single transaction. It should come as no surprise that there are some moves being made to try and avoid Ethereum’s high fees. There are attempts to limit the ETH gas limit by allowing more transactions and this should decrease the fees that users pay to transact on the network.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post