ETH drops below $3800 but the traders are not willing to short the current levels as the network saw a nine-fold increase in the smart contract deposits but a decreasing channel continues to put pressure on the price so let’s read more in today’s Etheruem price news.

Even though ETH reached a $4870 all-time high and the bulls have little reason to celebrate. The 290% gains year to date were overshadowed by the 18% price drop. However, the network value locked in smart contracts increased nine-fold to the $155 billion level. Looking at the past few months of the price performance it doesn’t really tell the whole story and Ether’s current market cap makes it one of the world’s top 20 tradeable assets behind the two-century-old Johnson and Johnson conglomerate.

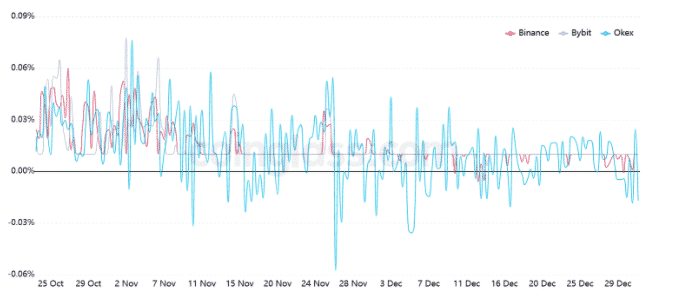

2021 should be remembered by the decentralized exchanges’ growth whose daily volume reached $3 billion or a 340% growth versus the last quarter of the year but the crypto traders are still short-sighted and accentuating the impact of the current downtrend channel. To understand the bearishness that it was installed, one has to analyze the futures’ funding rate. Perpetual contracts also known as inverse swaps have an embedded rate that is charged every eight hours and these measures are established to avoid exchange risk imbalances so the positive funding rate indicates that the buyers demand more leverage.

The opposite situation happens when shorts require additional leverage and this can cause the funding rate to turn negative. The eight-hour fee was raining near-zero back in December which only indicates a balanced leverage demand from the buyers and the sellers and if there were some panic moments, it would have been reflected on these indicators. Exchange-provided data highlights traders’ long-to short positioning and by analyzing the client’s positions on the spot, the perpetual and futures contracts as well can better bring an understanding of whether professional traders are becoming bullish or bearish.

There are a few discrepancies in the methodology between different exchanges so the viewers should monitor the changes instead of the figures. Despite the fact that ETH drops below $3800, the traders on OKEX, Huobi, and Binance increased their leverage longs. Binance was the only exchange that faced a modest reduction in the top traders’ ratios. The figure moved from 0.98 to 0.92 but this impact was more than compensated by the OKEX traders that increased their bullish bets from 1.67 to 3.20 in one week.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post