ETH drops below $1000 on Uniswap as the whale market tries to repay the debts and the Ethereum whale unleashed a huge position to repay debts which caused the WETH price to crash so let’s read more today in our latest Ethereum news.

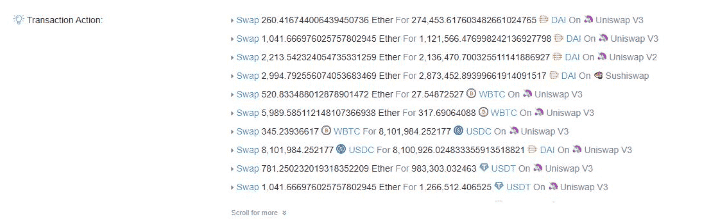

In the past few days, the crypto market saw some extreme turbulence and massive volatility so, during the turmoil, one whale liquidated a huge amount of ETH and pushed the price on Uniswap to 941 USDC before recovering. The ETH whale liquidated a huge amount of wrapped ETH on Uniswap which boosted the price down to 941 USDC. The transaction can be tracked on the ETH explorer and also visible in the transaction is that the whale used some of the funds to repay some loans.

At the time of writing, the price returned to where the rest of the market trades below $1300. ETH Drops below $1000 and it is down by 11.2% ont eh day and 30% on the week. Data shows that there were over $170 million in liquidated ETH positions in the past day and in the meantime, the broader market is about $50 billion away from dropping below $1 trillion. The last day saw more than $500 in total liquidations while BTC had a field day and pushed the price below $26,000.

As recently reported, The ETH core developers delay the Difficulty bomb after meeting on Friday and potentially delay the Merge which will migrate the network from a PoW consensus to a PoS. The difficulty bomb was planted in the ETH code in 2015 as a measure to force validators and accept the merge. The implementation of the merge dubbed went live on the Ropsten testnet a few weeks ago and after the testnet merge and the discussion of a number of bugs revealed by the test merge, the developers proposed EIP-5133 to delay the bomb to August 2022 and have been already delayed five times before.

The past 24 hours brought more pain to the crypto market with BTC dumping to a low of over $27,000 but the alternative coins suffered even more. ETH, for example, crashed below $1500 to a 2018 ATH level. After a few attempts to overcome $32,000 last week, the main crypto started losing value gradually and the last rejection brought it down to $30,000 where the asset remained for a few days. The landscape changed when the US inflation numbers went to 8.6%.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post