The ETH DeFi mania that has been going on over the past few weeks, surely proved to be exciting but according to analysts and researchers, the mania will soon end. Let’s see how in the upcoming ethereum news today.

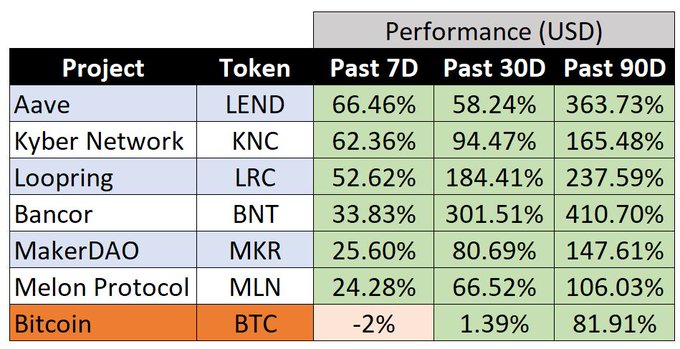

The use of ETH and DeFi in the industry became overwhelming over the past weeks as trends shifted in the favor of the two. Tahar Zafar, a crypto analyst, explained the trends well. According to him, the Ethereum-based tokens such as Kyber Network’s KNC, Aave’s LENd, and Bancor’s BNT, all surpassed Bitcoin. Even Ethereum which is most often used directly in tandem with the largest cryptocurrency was outperforming the market leader.

#DeFi is one of the most exciting things going on in the #crypto right now, but the idea that this sector will decouple from the rest of the market is ludicrous. Eventually, the mania will end, and DeFi will trade in line with the rest of the market.

— Weiss Crypto Ratings (@WeissCrypto) June 24, 2020

Defi-related tokens increased multiple times by a hundred percent over the recent months which coincided with the exponential increase in the economic power of the entire ecosystem. DeFi pulse reported that the value of the cryptocurrency locked in Defi apps reached $1.6 billion which is three times higher than it was seen in March and about 60% higher than it was 10 days ago. According to Weiss Crypto, the ETH Defi mania will go into normality once again soon:

“DeFi is one of the most exciting things going on in crypto right now, but the idea that this sector will decouple from the rest of the market is ludicrous. Eventually, the mania will end, and DeFi will trade in line with the rest of the market.”

Supporting these expectations of a market correction is the roadblocks that Defi is facing now. despite the many moves to increase the gas of each eth block, the transaction fees are still high. It can cost dozens of dollars to send a transaction as some users noted. The high fees prevent smaller holders from participating in the ecosystem which is a reason why the DeFi’s rate will depress. Also, it is subject to medium-term latency issues according to Multicoin Capital’s Kyle Samani. Samani explained that Decentralized finance will not succeed with Ethereum in this state that it is now.

“You just can’t build global scale trading systems for lots of users on POW chains. It just doesn’t work. High latency –> all kinds of negative second order effects. So I think for now we are near a plateau for DeFi – measured in ETH terms (not USD) – until the core latency problems are solved.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post