ETH-based holdings for institutional holders have increased by 19% in the third quarter of this year according to the latest SEC filings from large companies. In the meantime, the Grayscale Bitcoin Trust holdings got down so let’s read more in our latest Ethereum cryptocurrency news.

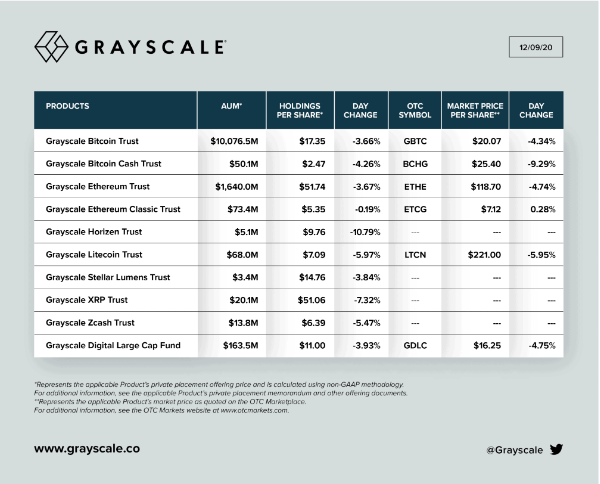

Bitcoin institutional holdings were down last quarter while most of the same companies upped their stakes in ETH-based products according to the new SEC filings. The number of Grayscale Bitcoin Trust shares that are in possession of large institutions dropped by 2.6% in the third quarter while the number of Grayscale ETH trusts shares increased 19% compared to the last quarter. Large institutional investment managers reported $546.8 million in GBTC and $74.6 million in ETHE by using the share prices from the two trusts of today. The companies with at least $100 million in assets under management are required to file a 13F Form in the next 45 days of the end of the quarter and disclose what is there in their portfolio.

In the latest batch of regulatory filings, 10 new companies disclosed that they had ETHE in their holdings and the two biggest ones were NYC-based Tocqueville Asset Management with 79,398 shares of the ETH trust and San Francisco-based Main Management ETF Advisors with 78,000 shares. The ETH-based holdings interest is growing as the trusts could be coming from the excitement about DeFi which is an umbrella term that describes financial products which allow users to lend, borrow or trade crypto assets without an intermediary.

In the meantime, a few other companies appear to have dropped their GBTC shares and the biggest one of those is Texas-based Outlook Wealth Advisors that sold its 60,000 shares of GBTC and reported that it now holds 60,000 shares of mining and software development company BTC Services Inc. At the start of this year, Bitcoin and ETH exposure showed up by way of the two Grayscale trusts alone but that is all changing now especially when it comes to Bitcoin.

Bitcoin Services Inc, Toronto-based 3iQ as the BTC fund, Idaho-based miner XTRA Bitcoin Inc and Osprey Bitcoin Trust from NEw York accounted for $17.5 million of the holdings reported in the third quarter.

buy vardenafil online http://expertcomptablenantes.com/wp-content/themes/twentytwentyone/classes/new/vardenafil.html no prescription

Cathie Wood’s Ark Invest is far still with the company’s biggest individual stake in BTC and ETH while ARK’s holdings account for 82% of all GBTC shares and 42.6% of the ETHE shares.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post