ETH and BTC Follow stock market in movements after the FED interest rate increase announcement and the crypto market cap gained 6% in one day so let’s read more today in our latest altcoin news today.

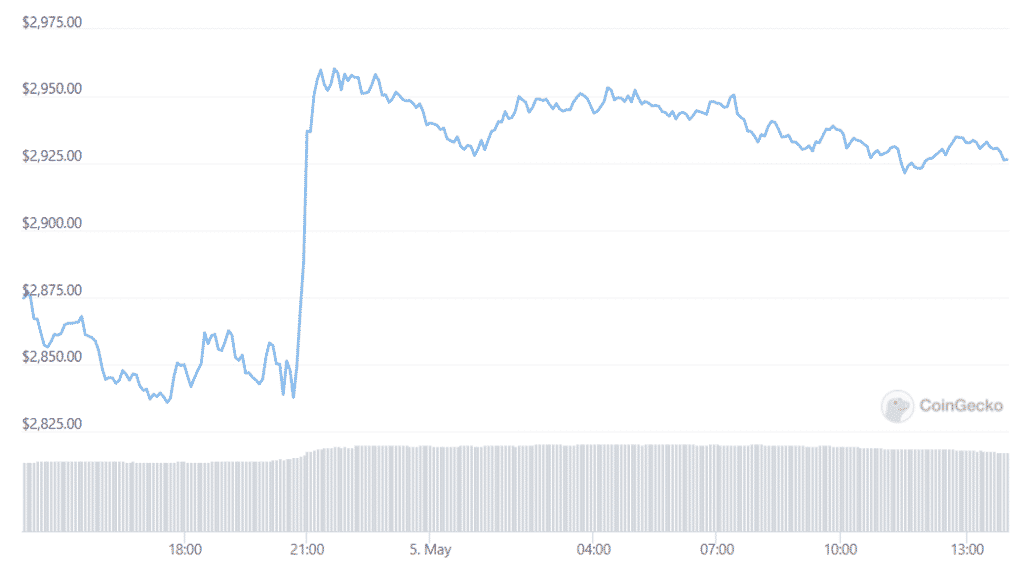

Interest rates are going up half a percentage point but the crypto and stock markets are headed up by a bigger chunk. The crypto marekt gained 6% in the past 24 hours with the top coins ETH and BTC follow stock market around the same figure. The biggest gainer in the top 10 was Cardano’s ADA which tailed a 13% increase and Solana, XRP, BNB, and Luna all recorded gains of about 5%. The upward adjustment maps well to returns on stocks within the Dow Jones Industrial Average and Nasdaq which gained 2.8% and 3.2% before the close of trading. The biggest factor that influenced the numbers is the Federal Reserve’s decision to raise interest rates by half a percentage which is the biggest increase since 2000.

When the FED raised interest rates, it increased the cost for financial institutions to borrow has a domino effect and the idea is to slow down or reverse the level of inflation by making money more expensive to come by so if this is the case, why is the stock market having such a banner day? The quick answer is that most investors thought the itnerest rate hike will be even larger. Alison Boxer was quoted saying:

“The main news from the press conference was that [Fed Chair] Powell pushed back on the 75 basis point hikes that markets had started to price in.”

The FED is prepared to raise rates further in the upcomign months and Powell indicated that a future 0.75 percentage point rise will likely not be in the cards. BTC was once thought of as a digital alternative to gold while its inflation-resistant store of value but took cues from the stock market. Bitcoin’s price movement is highly correlated with the rest of the crypto market but although crypto is up today, it is less flat over the past week at a market cap of $1.8 trillion. The tech stocks got hammered this year but the overall marekt cap started the year at $2.2 trillion and it is down by a double-digit percentage.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post