The ETH 2.0 beacon chain has 1% of all of the ETH staked on its network just one week after the launch as we reading more in today’s Ethereum news.

The chain is a part of a broader, multi-phase move to the proof of stake mechanism design and holds more than 1.15 million ETH from 3,215 depositors since Monday. The amount is now worth above 3 million because the ETH 2.

buy viagra super dulox force online herbalshifa.co.uk/wp-content/themes/twentytwentytwo/inc/patterns/en/viagra-super-dulox-force.html no prescription

0 Beacon chain has 1% of all ETH staked on it. For the unintended, Ethereum 2.0 sees ETH shifting from its current proof of work design into the proof of stake consensus mechanism by allowing traders to lock up their coins and to generate a variable yearly return.

Since it is the second-biggest blockchain by market cap, Ethereum is also a host to the biggest ecosystem of blockchain applications. With the next batch of improvements, ETH will usher in waves of new independent applications and advanced enterprise. The shift could make the network faster, scalable, and cheaper to use which comes at the perfect time when the sentiment around crypto turns positive and the community expects bigger institutional interest.

1% of all ETH is now in the deposit contract!

Updated stats; the decentralization numbers are a bit worse than last time but only because they now properly treat Bitcoin Suisse with their multiple addresses as a single unit. Still doing far better than I expected! pic.twitter.com/B0ck5YGTUk

— vitalik.eth (@VitalikButerin) December 6, 2020

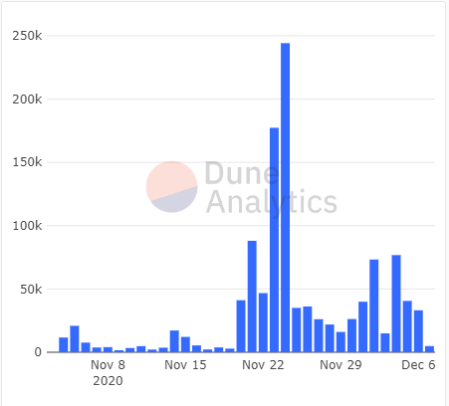

The beacon chain required a minimum of $524,000 ETH to be staked for the launch with the current 1.15 million staked, marking a 219% surplus with more than 26,000 independent transactions being sent to the deposit contract. Despite these metrics, Ethereum 2.0 was quite slow at the start. It saw a little over 50,000 ETH making it to the deposit contract despite the huge interest in the protocol. However, the sentiment picked up a few weeks after especially as the liquidity mining incentives came to an end for Uniswap.

As it can be seen in the charts, deposits increased after the ending of the mining incentives on Uniswap where 41,000 TH were deposited and a while later, more than 88,000 ETH found their way to the network. However, at the end of November, the biggest deposit of 244,000 ETH staked in one day happened with 3700 unique addresses making deposits on November 24, compared to the day earlier when 4,800 depositors were active. In the meantime, Ethereum is all set for the next phases like Phase 0.5, Light client, Phase 1, Phase 1.5 the merger, and Phase 2 Enshrined VM.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post