The DeFi effect can clearly be seen in the ethereum transactions which are nearing the 2018 ICO boom level as most of the activity is attributed to the rise of Layer-2 applications and DeFi. In our latest Ethereum news, we take a closer look at the analysis.

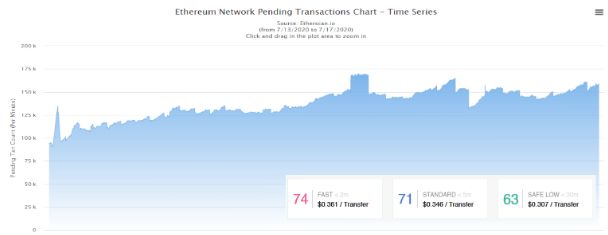

The data shows Ethereum transactions are getting close to the 2018 levels as the GAS prices increased and are set at record highs. Transactional activity broke the 1 million per day level which was set last year, and it is nearing 1.3 million per day as it was seen in January 2018. The current transaction activity is ranging between the 1.1 and the 1.2 million/day level.

Some people think that #Ethereum will be successful but $ETH won’t have any value.

Let me debunk this meme with one single plot. pic.twitter.com/vwfNdZp2tM

— Mo (@MorganTBennett) July 16, 2020

The charts coincide with the increase of DeFi applications and projects such as Compound, Aave and Balancer gained a lot of supporters and media interest in 2020 and their increase in popularity is the same with the surge in Ethereum transactions. All DeFi tokens account for 1.44 percent of the total crypto space as the sector volume reached $456 million over July. The sector returned 6.53 percent to investors in the past few days and this is the most among the other sub-sectors such as general currencies, privacy tokens, and smart contracts.

There’s a price-wise look to it as well. One economic model suggests that Ethereum’s price will be booster by DeFi’s growth which was proposed by the analyst Morgan Bennet earlier this week. In the meantime, the mempool data on Ethereum is not helping the cause. The transaction fees soared in the past week and cost more than $10 on some transfers. The DeFi effect can also be seen to the DeFi token usage as the top coins run on the ETH mainnet.

The Reddit thread captured some of the community sentiment for this matter:

“The high gas prices make it really painful (and sometimes confusing) to interact with (a) smart contract.”

Ethereum’s bigger ecosystem however is working to solve some of the problems. Consensys-backed starkware reached 9000 transactions per second back in May while Matic Network reported 7200 tips over the last week. As the current TPS is set between 12-15, the block data shows the layer-2 designs, and rollup tech will power the network to more than 1 million tps.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post