According to the Data Scientist and investor Osho Jha, the staking process will make Ethereum a functional store of value so let’s find out more in the upcoming Ethereum news.

The tech company and executive find unique data sets for investing in the public and private markets. After the halving, the changes in Ethereum went largely unnoticed in the bigger crypto community. Bitcoin became an investment option for everyone that seeks strong money principals in a time when central bank balance sheet expansions and ETH represents strong money principals.

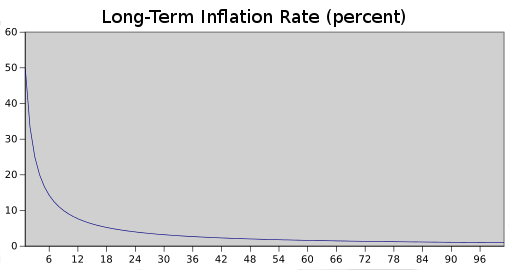

Ethereum 2.0 had multiple delays which are usual for a software development process but the primary cause of negative sentiment for ETH. However, the new ethereum upgrade seeks to change from a PoW infrastructure to a PoS infrastructure and according to the data scientist Osho, this is not reflected in the price of the ETH token. Before analyzing the impact of the staking, it’s important to know how the ETH money supply works. Bitcoin has a fixed supply of 21 million coins and the rate at which the coins are released, decreases over time. ETH doesn’t have a fixed supply but it has a declining inflation rate.

There’s a fixed issuance of new coins every year and as the money supply grows, the fixed issuance becomes a smaller portion of the money supply. ETH reduced the block reward for the miners and with the upgrade, the staking mechanism is set to reduce the rate to 2.0%. Despite the negative connotations in the crypto community, the fiat currencies are not bad and have an advantage of the unfixed supply which is the flexibility to adjust during economic climates.

ETH trades like a venture investment and as some believe that Ethereum will be the underlying technology for the decentralized apps and they buy ETH, in the same way, it would do so with shares. ETH is not a stock and these investors are taking on a bigger risk than they think. Staking is the key to make ETH function as a value store and staking incentivizes holding ETH in a node that can be used by the network to verify transactions. The bigger the number of nodes, the faster the network can function. For Investors, there are incentives to stake tokens in a node including the rewards to earn interest on a bank deposit.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post