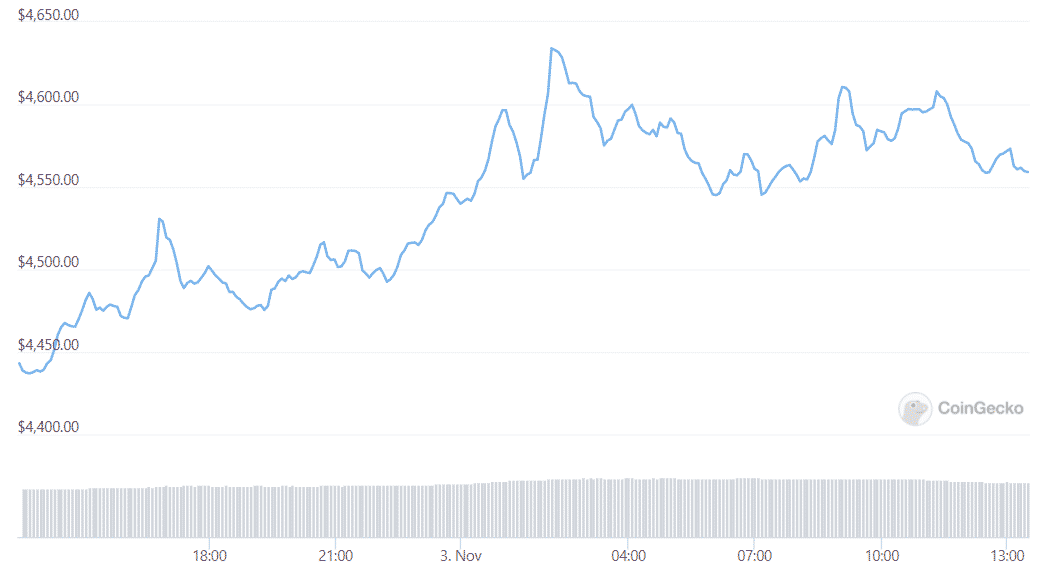

Moments after CME announced micro ETH futures, the price of the asset surged to a new all-time high above $4600 as we can see in our latest Ethereum news today.

Ethereum prices soared to a new high during the Wednesday morning Asian trading sessions after CME announced micro ETH futures launch. ETH hit a new all-time high of $4635 accoridng to CoinGecko. The world’s biggest smart contract network built its weekly momentum to hit a new peak and reach a 6% gain on the day. In the past week, ETH added another 10% and it is up by 34% over the past month. The price of ETH cooled off since and it is now trading around $4500. PrimeXBT partner Byzantine General commented that tehre will not be many tokens that can outperform ETH over the next few months:

“$ETH making new all-time highs while funding rates are low, meanwhile the rest of the market has very high rates.

I think the most important question right now is “what’s going to outperform ETH next couple of months?”.

And the answer is probably: “not much”. pic.twitter.com/CAQCrunEwI

— ₿yzantinΞ General (@ByzGeneral) November 3, 2021”

The analyst thinks that Bitcoin could reach a new high as well and will drain the liquidity from the rest of the market as it occurred in the previous market cycles. The momentum is now with Etheruem however as many new participants are getting onboarded with Defi and NFTs. He added that there are two ways that the market can pump either BTC or ETH will drag it along:

“Right now it’s basically a tech (ETH) versus money (BTC) argument. I’m not saying tech is worth more, I’m just saying the market values the tech more at this point in time.”

Ethereum reserves on exchanges dropped a little more than BTC and this only suggests that the investors are holding ETH and are using it to generate the yields in Defi. There were other arguments as well to his sentiment with many saying that the rival Blockchain tokens like AVAX, dOT, and SOL will soon outperform ETH. As the recent data shows, the Ethereum network settled a record $536 billion during Q3 in 2021.

Ethereum’s monetary model is also going to keep the prices rising since in the past week we saw the Etheruem issuance being deflationary because more has been burnt by the EIP-1559 than it has been mined. According to Ultrasound.Money, the fee-burning tracker, more than 741,000 ETH has been destroyed since August which is equivalent to $3.4 billion.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post